La réaction positive des marchés actions aux élections américaines traduit en partie le soulagement de voir une campagne électorale traumatisante se terminer et, surtout, la probabilité d’avoir un Congrès divisé.

Il y a fort à parier que cela engendrera une forme de blocage réglementaire qui empêchera grandement le nouveau gouvernement de revenir sur les allègements fiscaux mis en place par Donald Trump et de durcir les contraintes imposées aux entreprises. Dans un contexte marqué par la baisse des taux obligataires, tout cela est de bon augure pour les grandes sociétés technologiques. Quand bien même l’incertitude d’un plan de relance budgétaire de grande ampleur pourrait momentanément plomber les secteurs cycliques, nous conservons un penchant pour la tech et les sociétés dotées de leviers de croissance structurelle dans plusieurs segments de la santé, tels que la biotechnologie, la pharmaceutique et les sciences de la vie.

La croissance américaine pourrait être anémique en l’absence de plan de relance substantiel. Relance budgétaire ou non, il y a fort à parier que la Fed interviendra dans les prochaines semaines car la nouvelle vague de la pandémie de covid-19 qui s’est abattue sur le territoire américain assombrit les perspectives à court terme. Les devises défensives comme le yen bénéficient de la baisse du dollar, ce qui justifie pleinement notre récente décision d’acheter des options de ventes USD/JPY. En outre, certaines devises émergentes pourraient profiter d’une stabilisation de la politique commerciale et de la politique étrangère des États-Unis.

Les résultats des entreprises pour le troisième trimestre se sont révélés nettement meilleurs que prévu. Cela étant, les perspectives pour le quatrième trimestre restent floues car les nouveaux cas de covid-19 se multiplient rapidement, tout particulièrement aux États-Unis. On y compte désormais plus de 120 000 nouveaux cas chaque jour, des chiffres records ayant été enregistrés pendant quatre jours consécutifs. Il se pourrait que l’Europe parvienne à contrôler une fois de plus la propagation du virus avec un temps d’avance sur les États-Unis, ce qui aurait des répercussions sur la croissance et sur les marchés financiers. Tout compte fait, nous escomptons des interventions de la Réserve fédérale et de la Banque centrale européenne (BCE) dans les prochaines semaines.

L’abandon soudain de l’introduction en bourse d’Ant montre que les considérations réglementaires dans le domaine des fintechs évoluent rapidement et nous rappelle qu’une convergence de tous les intérêts est nécessaire avant d'investir dans des introductions en bourse. Malgré cela, la reprise de l’économie chinoise poursuit son accélération, ce qui est reflété dans la progression de ses marchés financiers. Nous restons enthousiastes à l’égard des actifs chinois, y compris le renminbi.

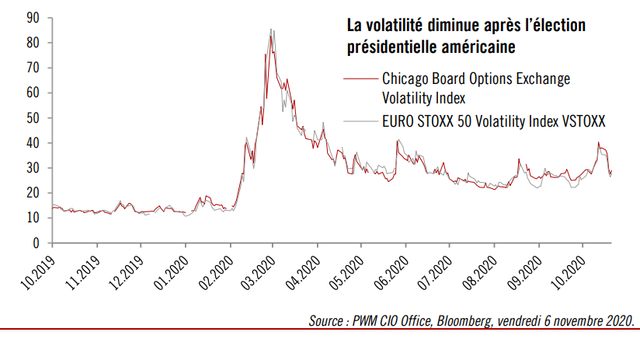

Graphique de la semaine : Une plus grande sérénité

Nous avons assisté à une poussée de volatilité sur les marchés actions à l’approche de l’élection présidentielle américaine du 3 novembre, mais depuis la situation s’est rapidement normalisée. Malgré l’absence de résultats définitifs, il est désormais clair qu’il n’y aura pas de « vague bleue » (c’est-à-dire, une mainmise complète des Démocrates sur la présidence et sur le Congrès). Cela a suffi à atténuer en partie l’incertitude et, partant, la volatilité des deux côtés de l’Atlantique.

Macroéconomie : L’Europe piétine, la Chine à toute vitesse

États-Unis : la reprise s’est poursuivie à un rythme soutenu en octobre

Il y a eu 638 000 créations d’emplois en octobre aux États-Unis. Cela a permis de faire reculer le taux de chômage à 6,9%, en comparaison au pic de 17,4% atteint en avril. Le nombre de nouvelles demandes d’inscription au chômage a légèrement reculé, pour s’établir à 751 000 durant la semaine se terminant le 31 octobre. Par ailleurs, l’indice HIS Markit de l’activité dans le secteur des services s’est hissé à 56,9 en octobre (contre 54,6 en septembre), tandis que les commandes d'usines ont progressé de 1,1% en septembre, signant ainsi leur quatrième hausse mensuelle consécutive.

En Europe, les nouvelles restrictions ont eu un impact sur l’activité dans le secteur des services

En zone euro, les indices flash IHS Markit des directeurs d’achat (indices PMI) font état d’une nouvelle contraction de l’activité dans le secteur des services en octobre, tout particulièrement en Espagne et en Italie. Ces chiffres contrastent avec ceux des indices PMI du secteur manufacturier, qui a profité d’un rebond des exportations. L’indice PMI composite pour la zone euro s’est établi à 50, en légère hausse par rapport à septembre (49,5).

L’économie chinoise va de l’avant

Preuve que l’économie chinoise poursuit son redressement, l’indice PMI Caixin/Markit du secteur des services a atteint 56,8 en octobre, soit son plus haut niveau depuis juin. Grâce à ce rebond, les services sont en train de rattraper leur retard sur le secteur manufacturier, qui a progressé à un rythme plus modéré en octobre. Les indices PMI font également état d’un fort rebond de l'activité dans les services en Inde et en Australie le mois dernier.

Marchés : Rebelote

Les marchés plébiscitent un Congrès divisé

À mesure que progressait le dépouillement des votes à l’élection présidentielle américaine, les marchés ont accueilli avec enthousiasme la perspective d'un Congrès divisé, car ils estiment que cela réduit le risque d’une forte hausse de l’impôt sur les sociétés et d’un durcissement du cadre réglementaire. Le S&P 500 a gagné 7,4%1 (en USD) sur la semaine et la volatilité est retombée. Sans surprise, les valeurs technologiques ont donné le ton, comme en atteste la progression de 9,1% du Nasdaq2 sur la semaine. Mais les espoirs réduits pour un grand plan de relance à court terme et les inquiétudes liées aux dégâts causés par la deuxième vague de la pandémie continuent de peser quelque peu sur les actions cycliques « value », ainsi que sur les valeurs bancaires, qui ont vacillé la semaine dernière à cause de l'aplatissement de la courbe des taux. Néanmoins, l’annonce de la victoire de Joe Biden, synonyme d’une politique commerciale moins imprévisible et d’une approche globale plus consensuelle, pourrait doper les marchés. Des mesures d’assouplissement monétaire de la Banque centrale européenne et de la Fed sont également à prévoir. Il convient de mentionner la hausse de 11,3%3 de l’indice EM Latin America (en USD), qui a grandement profité de la baisse du dollar.

Une semaine mouvementée pour les bons du Trésor

Les bons du Trésor américain en ont vu de toutes les couleurs la semaine dernière : les taux se sont repliés dans la perspective d'un Congrès divisé, mais le taux à 10 ans est reparti à la hausse après la publication de bons chiffres de l’emploi, terminant la semaine en baisse de 4 points de base seulement par rapport à la semaine d’avant, à 0,84%. Les bons du Trésor auront sûrement du mal à suivre une trajectoire bien définie jusqu’au second scrutin qui aura lieu en Georgie en janvier qui déterminera la composition du nouveau Sénat (et, partant, les chances des Démocrates de faire adopter un plan de relance de grande ampleur). En attendant, la perspective de voir la Fed intervenir de nouveau en cas de prolifération des cas de covid-19 et de dégradation de la situation économique signifie que les taux obligataires pourraient continuer à subir des pressions à la hausse comme à la baisse, même si l’idée que le taux à 10 ans pourrait atteindre prochainement 1% semble de moins en moins réaliste. En Europe, les taux obligataires se sont également repliés sur fond de propagation de la pandémie de coronavirus. Le crédit a connu une nouvelle semaine faste, comme en atteste l’excellente performance du haut rendement américain, qui reflète davantage la hausse des marchés actions qu’une amélioration des fondamentaux (quand bien même certains signes montrent une stabilisation des taux de défaut).

L’élection américaine, une aubaine pour les devises des marchés émergents

Le regain d’appétit pour le risque observé après l’élection présidentielle américaine et la perspective d’un Congrès divisé (qui limite la probabilité d’un grand plan de relance et, partant, confère à la Fed la lourde tâche de soutenir l’économie) a mis le dollar sous pression la semaine dernière : le billet vert a cédé du terrain face aux autres devises, en particulier face aux devises des marchés émergents. Le renminbi a notamment poursuivi sa progression, dopé par une croissance économique insolente et par la perspective d’un apaisement des relations entre Pékin et Washington. L’indice renminbi pondéré en fonction des échanges commerciaux est supérieur de près de 3% à sa moyenne mobile sur 200 jours, ce qui s’est révélé être une zone de résistance par le passé. À l’heure où les autorités chinoises semblent favorables à une monnaie dont le cours est davantage dicté par le marché, il se pourrait que cette résistance saute bientôt. Les devises émergentes les plus sous-évalues ont signé les meilleures performances hebdomadaires, à l’exception de la lire turque car plusieurs facteurs domestiques ont éclipsé la faiblesse du dollar.

3 Source : Pictet WM AA&MR, Thomson Reuters. Performances historiques, Indice Latin America (performance nette en USD sur 12 mois) : 2015, -30.8% ; 2016, 31.5% ; 2017, 24.2% ; 2018, -6.2% ; 2019, 31.6%.

César Pérez Ruiz, Directeur des investissements

Pour accéder au site, cliquez ICI.