Selon Vontobel, l’économie mondiale atteint un niveau d’incertitude inédit depuis le déclenchement de la Crise financière mondiale (CFM) de 2008. Le monde est confronté à de multiples défis — inflation en hausse, fin de l’assouplissement monétaire, perturbations dans la chaîne d’approvisionnement, confinements en Chine et guerre tragique en Ukraine.

Lors de la présentation des résultats du premier trimestre de JP Morgan Chase, son PDG Jamie Dimon a annoncé la constitution de réserves en raison des risques accrus liés à la flambée de l’inflation et au conflit en Ukraine. Comme M. Dimon, nous estimons que la meilleure façon pour les investisseurs d’affronter l’incertitude macroéconomique consiste à se préparer.

De manière étrange, les marchés actions ne semblent guère effrayés par l’accumulation des risques macroéconomiques, malgré la multiplication des alertes. Si les multiples de valorisation sont nettement supérieurs à la moyenne de long terme, les stratégistes des grandes banques d’investissement voient le S&P500 atteindre 5 200 en fin d’année, soit une hausse de 25% par rapport au niveau actuel.

Or, nous pensons que les investisseurs sous-estiment le risque d’un marché baissier pour 3 raisons. Dans un tel scénario, nous recommandons de privilégier les actions de qualité afin de minimiser les pertes en capital.

1. Les valorisations et les prévisions du consensus n’intègrent aucune marge de sécurité pour la montée des risques macroéconomiques.

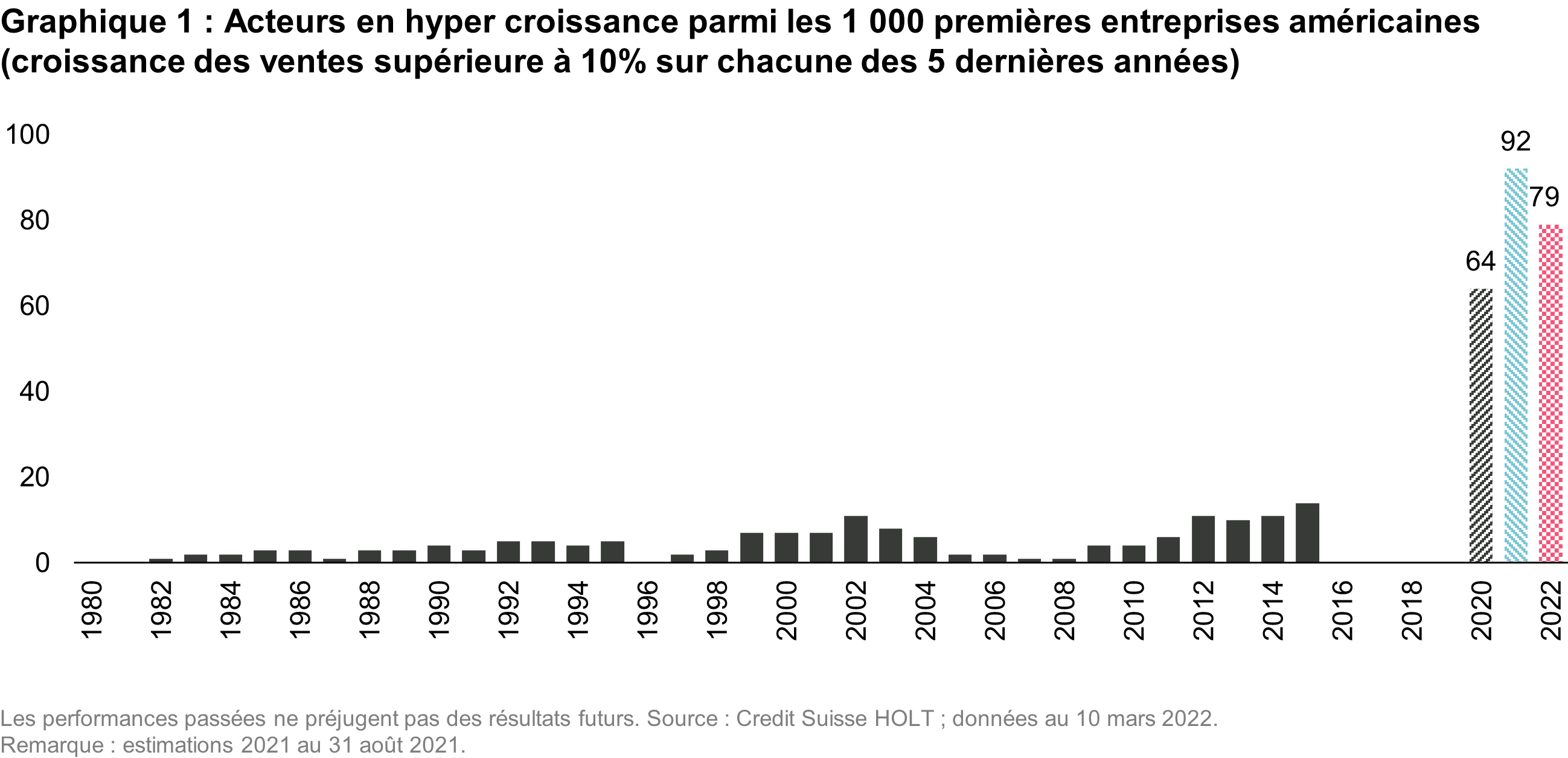

En ce qui concerne l’indice S&P 500, le consensus prévoit une croissance du BPA de 10% sur 12 mois, les prévisions de bénéfices des entreprises étant censées retrouver la tendance pré-pandémie d’ici la fin de l’année. Les anticipations sont particulièrement optimistes pour les sociétés en hypercroissance — le segment le plus spéculatif du marché. Depuis les années 1980, le nombre d’entreprises en hypercroissance – susceptibles d’avoir une croissance annuelle des ventes supérieure à 10% pendant au moins cinq ans – se situe en moyenne entre 10 et 15. Actuellement, le consensus parie que plus de 70 entreprises parviendront à réaliser cet exploit (graphique 1).

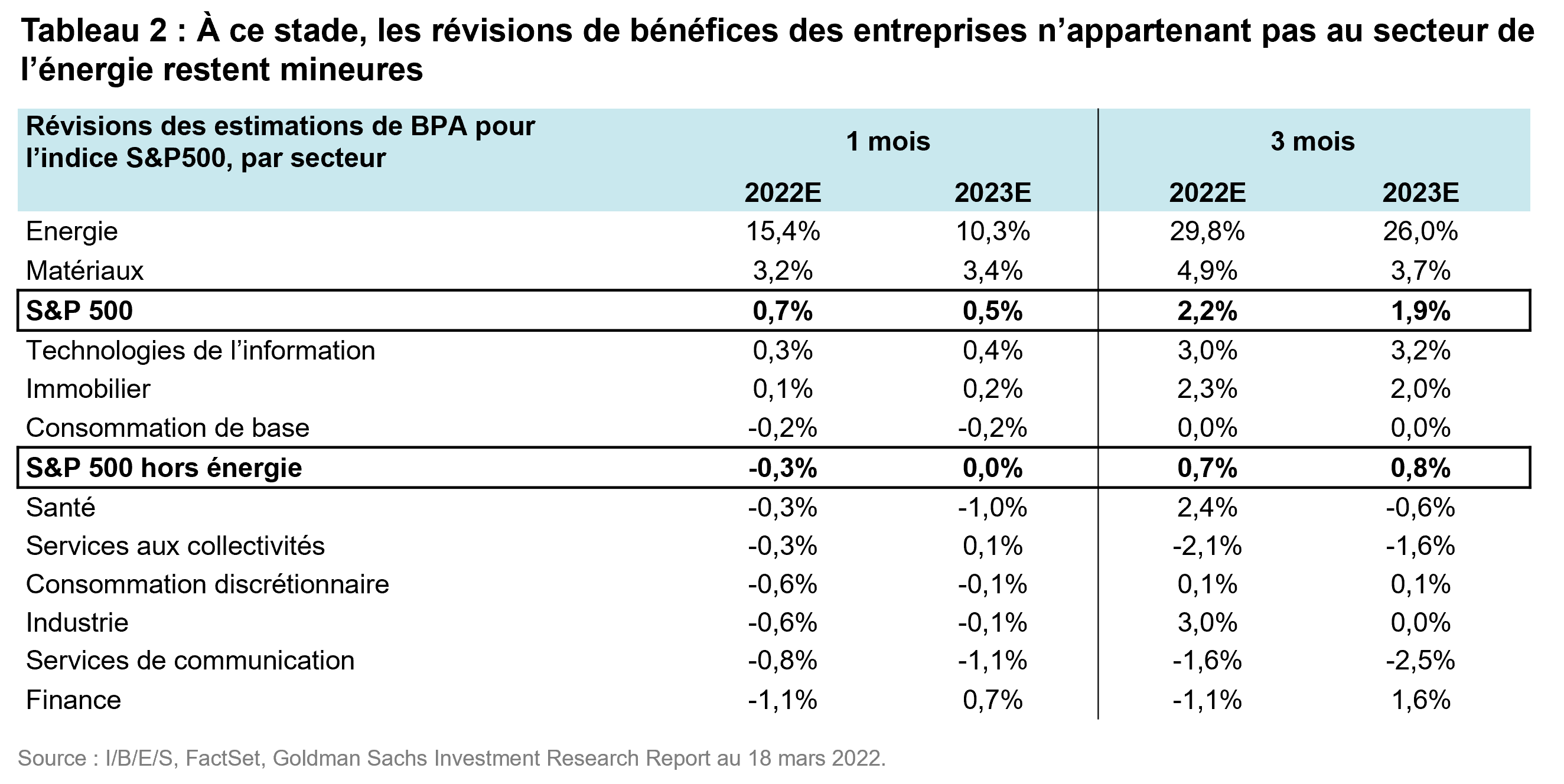

Pour les entreprises n’appartenant pas au secteur de l’énergie, les chiffres du consensus n’ont guère varié au cours des trois derniers mois (tableau 2). Globalement, le consensus parie ainsi sur un retour à la normale. A ce stade, le marché estime donc que les difficultés macroéconomiques appartiennent au passé. Il convient cependant de rappeler que pendant les récessions des 30 dernières années, les bénéfices ont chuté de 20 à 50%.

En ce qui concerne les valorisations, le marché affiche un ratio C/B à terme de 19x, contre une moyenne de long terme de 16x. En 2018, le taux des Fed Funds se situait à 2,4% (un niveau proche de l’objectif actuel de la Fed) et le ratio C/B du marché s’établissait à 14x. Durant la Crise financière mondiale, ce ratio a même atteint un plancher de 11x. Le système bancaire étant mieux capitalisé aujourd’hui, ce niveau extrême est désormais peu probable. Néanmoins, dans l’hypothèse où les bénéfices reculent au niveau médian des récessions passées (25-30%) et où les multiples chutent vers 14x-16x, une correction de l’ordre de 30 à 40% des marchés actions n’est pas impossible.

2. Si le consensus se veut optimiste quant à la croissance des bénéfices, ses prévisions ne constituent pas un indicateur historique fiable des corrections à venir.

Les mouvements à la baisse se produisent sans crier gare. Les marchés entament généralement une correction après un événement inattendu, comme la faillite de Lehman Brothers, qui a déclenché la Crise financière mondiale. A cet égard, la guerre en Ukraine et ses conséquences (notamment la flambée des prix des matières premières) auraient pu constituer un choc suffisant. Or, les consommateurs américains continuent de dépenser, le marché immobilier reste tendu et les entreprises atteignent leurs objectifs en matière de bénéfices. Les investisseurs ancrant leurs prévisions dans les tendances récentes, le marché restera soutenu aussi longtemps que les données économiques rétrospectives seront positives et que les entreprises maintiendront leurs prévisions.

Nous souhaitons toutefois inciter les investisseurs à la prudence. Tout d’abord, certaines entreprises de faible qualité commencent à abaisser leurs prévisions. Les entreprises ne détenant pas de pouvoir de fixation des prix peinent à compenser la flambée des coûts des matières premières et les perturbations de la chaîne d’approvisionnement. Vestas, l’un des plus grands fabricants de turbines éoliennes, a récemment annoncé des marges proches du seuil de rentabilité pour 2022. Du côté de la consommation, les prévisions du consensus pour Electrolux – l’un des plus grands fabricants d’appareils ménagers – ont chuté de 20% après la publication de chiffres décevants au premier trimestre. Même les résultats de Domino Pizza ont été inférieurs aux attentes en raison d’une pression importante sur son activité de livraison, due à un manque de personnel.

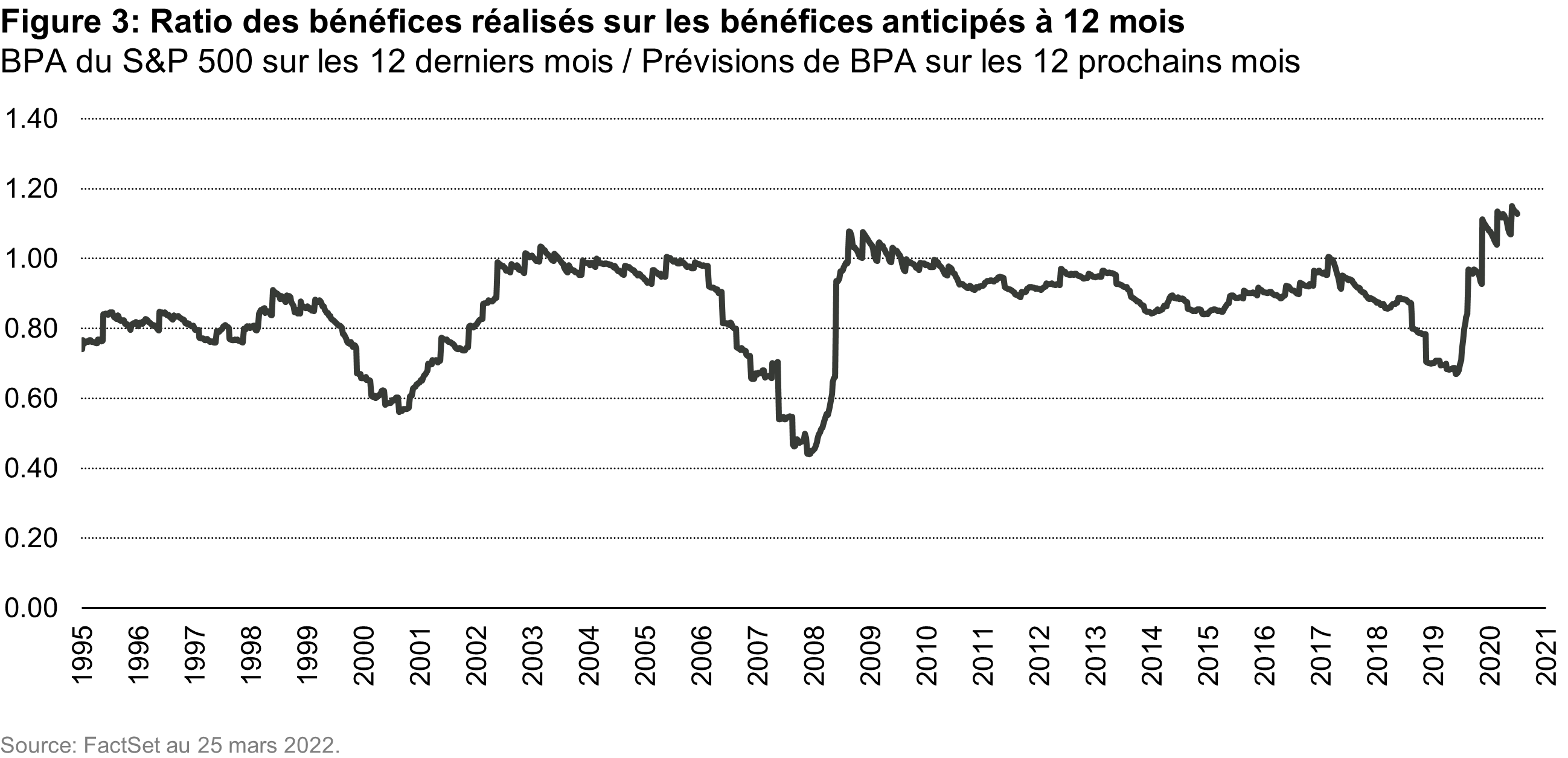

Historiquement, les chiffres du consensus ne permettent pas de prédire les points d’inflexion. Nous avons analysé la relation entre les bénéfices anticipés et réalisés sur les 25 dernières années, en calculant leur ratio sur des périodes de 12 mois. Un ratio inférieur à 1 signifie que les bénéfices réels se sont avérés inférieurs aux prévisions — ces dernières ont été trop optimistes (graphique 3). Nous relevons deux points intéressants dans le graphique ci-dessous. Premièrement, on observe que le ratio est en moyenne inférieur à 1. Deuxièmement, la variation du ratio est plus importante avant les récessions et les reprises (1999/2001 ; 2006/2008 ; 2017/2020).

Nul ne peut prédire quel événement déclenchera une correction du marché, mais Mara Der Hovanesian, analyste d’investigation et « CSO » (Chief Skeptical Officer) de Vontobel, nous met en garde contre le volume croissant de la dette d’entreprise, en particulier sur le marché des prêts à effet de levier (dette privée à haut rendement). Au cours de la dernière décennie, le marché des prêts à effet de levier a triplé pour atteindre environ 1 400 milliards USD, tandis que le marché plus large des obligations d’entreprise a presque doublé pour atteindre environ 10 000 milliards USD en 2019.

Alors que les banques traditionnelles sont limitées par le durcissement de la réglementation adopté dans le sillage de la Crise financière mondiale, d’autres acteurs – fonds de private equity, compagnies d’assurance, fonds de pension et gestionnaires de CLO (investisseurs professionnels en prêts) subissent moins de contraintes. Dans ses premières perspectives annuelles sur les risques, le bureau du surintendant des institutions financières (BSIF) du Canada alerte sur le rôle accru de la dette à haut rendement et des prêts à effet de levier, y compris les prêts à clauses allégées (qui comportent moins de protections pour les prêteurs). Selon le BSIF, ces actifs sont davantage exposés aux augmentations des coûts de financement, aux demandes de liquidités et à l’appétit de refinancement lorsque les marchés deviennent volatils. Etant donné que les investisseurs institutionnels (compagnies d’assurance, fonds de pension, etc.) sont les principaux détenteurs de cette catégorie d’actifs, une correction touchant les titres à haut rendement risquerait de se propager à l’ensemble des marchés financiers.

3. Les valeurs de rendement ne sont peut-être pas aussi bon marché qu’on l’imagine

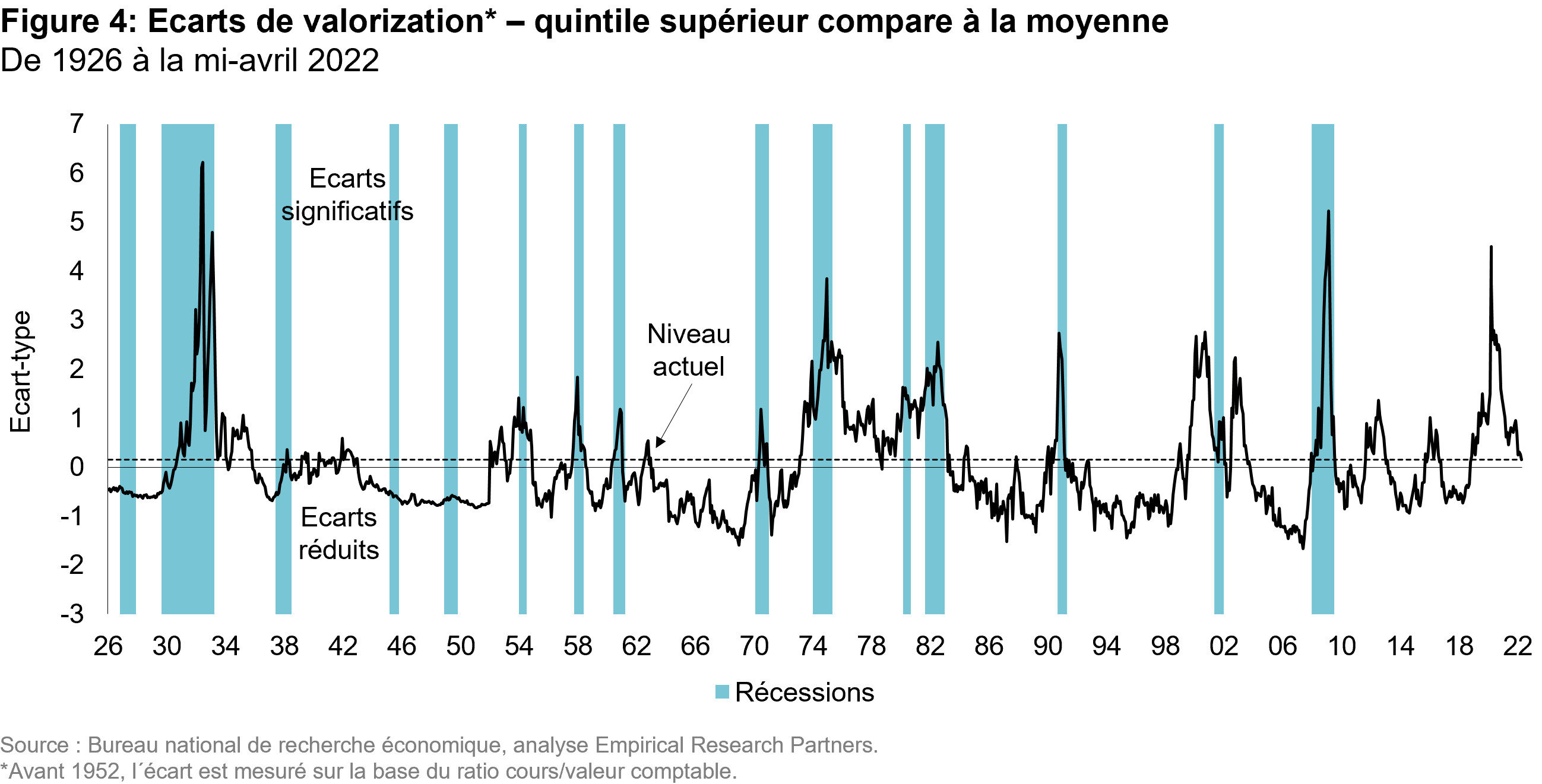

Les titres des entreprises de faible qualité – qualifiés de valeurs de rendement parce qu’ils se négocient à un ratio C/B inférieur à celui du marché – ont surperformé ces deux dernières années, car le marché a réévalué l’impact de la réouverture après la COVID et pris en compte l’effet de la hausse des taux d’intérêt sur les valorisations. Si ces valeurs de rendement affichent toujours, en moyenne, une décote par rapport au marché, cette dernière est aujourd’hui inférieure à sa moyenne de long terme (graphique 4).

Nous pensons que la surperformance des multiples entre les actions de qualité élevée et de faible qualité deviendra moins pertinente pour la performance relative totale dans une économie stabilisée. Par conséquent, la surperformance proviendra très probablement de la surperformance relative (rendement du dividende + croissance des bénéfices). Il s’agit d’une excellente nouvelle pour les investisseurs qui ciblent la croissance de qualité et privilégient, dans leur sélection de titres, une performance totale prévisible plutôt que l’expansion des multiples.

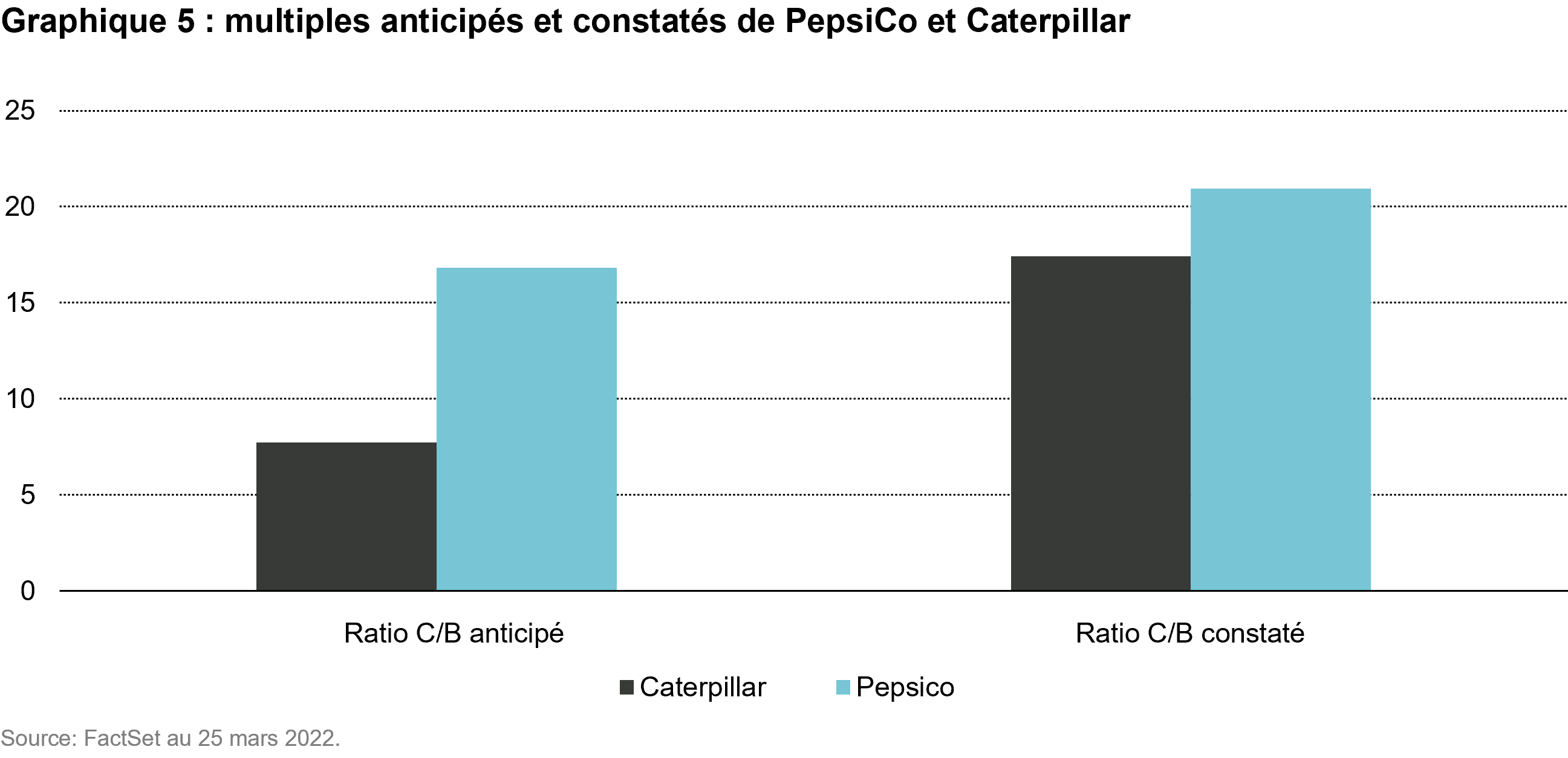

Dans l’hypothèse d’une entrée en récession, qui viendrait ternir le consensus des bénéfices, nous pensons que les bénéfices des entreprises de qualité devraient mieux résister et que la prime de valorisation entre les actions de qualité et les valeurs de rendement pourrait ne pas être aussi importante que les multiples actuels le suggèrent. A des fins d’illustration, nous avons comparé les ratios C/B de PepsiCo et de Caterpillar, avant et après la Crise financière mondiale. Si l’action PepsiCo se négociait avec une prime de 117% par rapport à l’action Caterpillar avant la crise, cette prime a ensuite diminué pour s’établir à 20%. Mais alors que les revenus et les marges de Caterpillar se sont respectivement contractés de 37% et de 700 pb sur la période, ceux de PepsiCo sont restés stables. PepsiCo a donc nettement surperformé pendant la crise, malgré un ratio C/B initial beaucoup plus élevé.

Les actions de qualité sont plus résilientes en période de récession

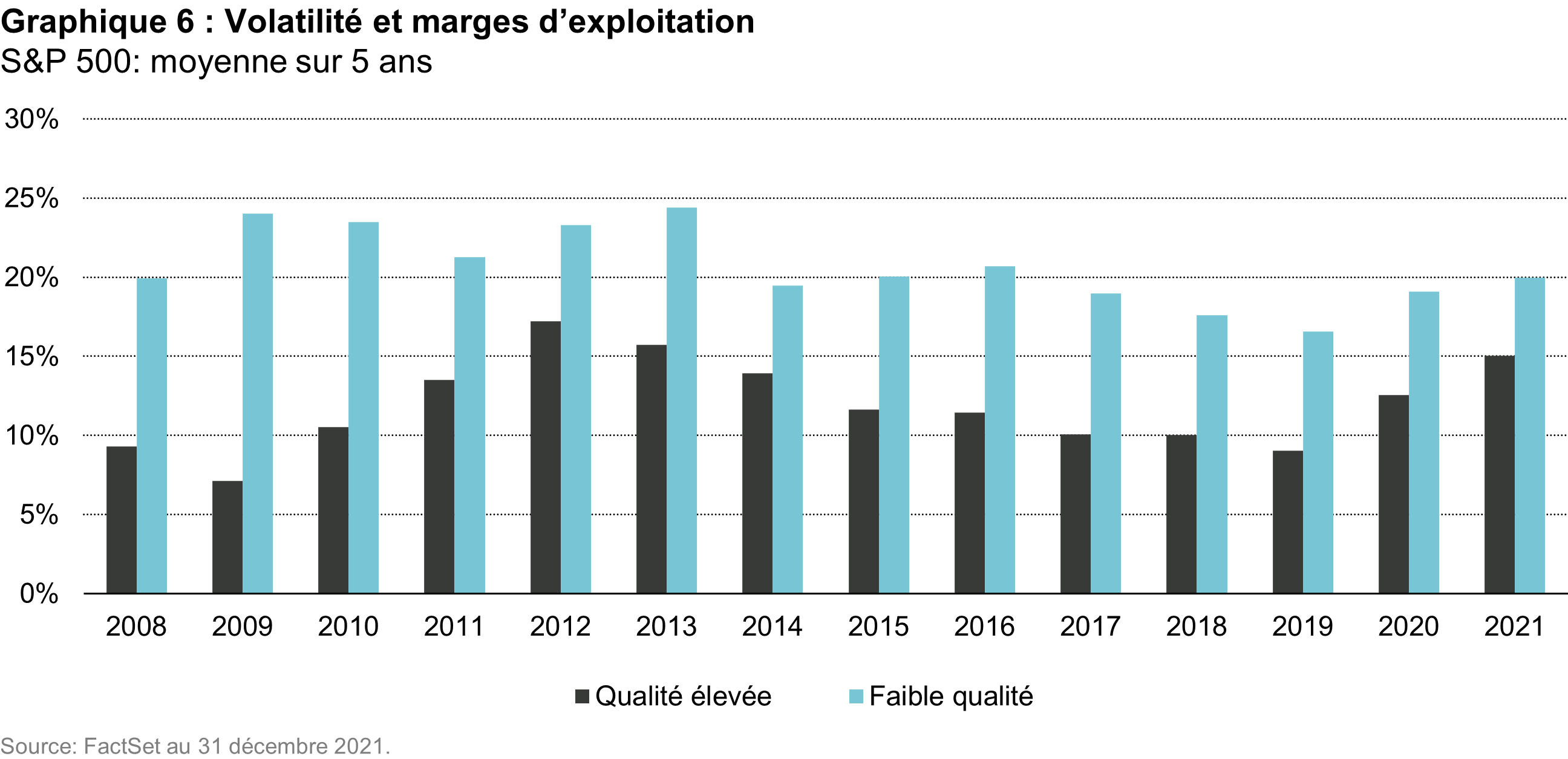

Les entreprises de qualité s’appuient généralement sur un meilleur pouvoir de fixation des prix et une plus faible élasticité de la demande, ce qui peut se traduire par une moindre volatilité des bénéfices (graphique 6). Au premier trimestre 2022, Sherwin Williams (SHW) – la plus grande entreprise américaine de revêtements – a publié des résultats supérieurs aux attentes, car son pouvoir de fixation des prix a plus que compensé la flambée des coûts des matières premières. Selon Rob Hansen, l’analyste qui couvre Sherwin Williams chez Vontobel, ce pouvoir de fixation des prix provient de la faible élasticité de la demande et de l’image de la marque. Dans un chantier de peinture, le coût de la peinture elle-même n’est pas très important, puisque les coûts de main-d’œuvre représentent 85% de la facture totale. En outre, SHW est le principal promoteur de sa propre marque, alors que ses concurrents s’appuient souvent sur les grands acteurs de la rénovation et les distributeurs.

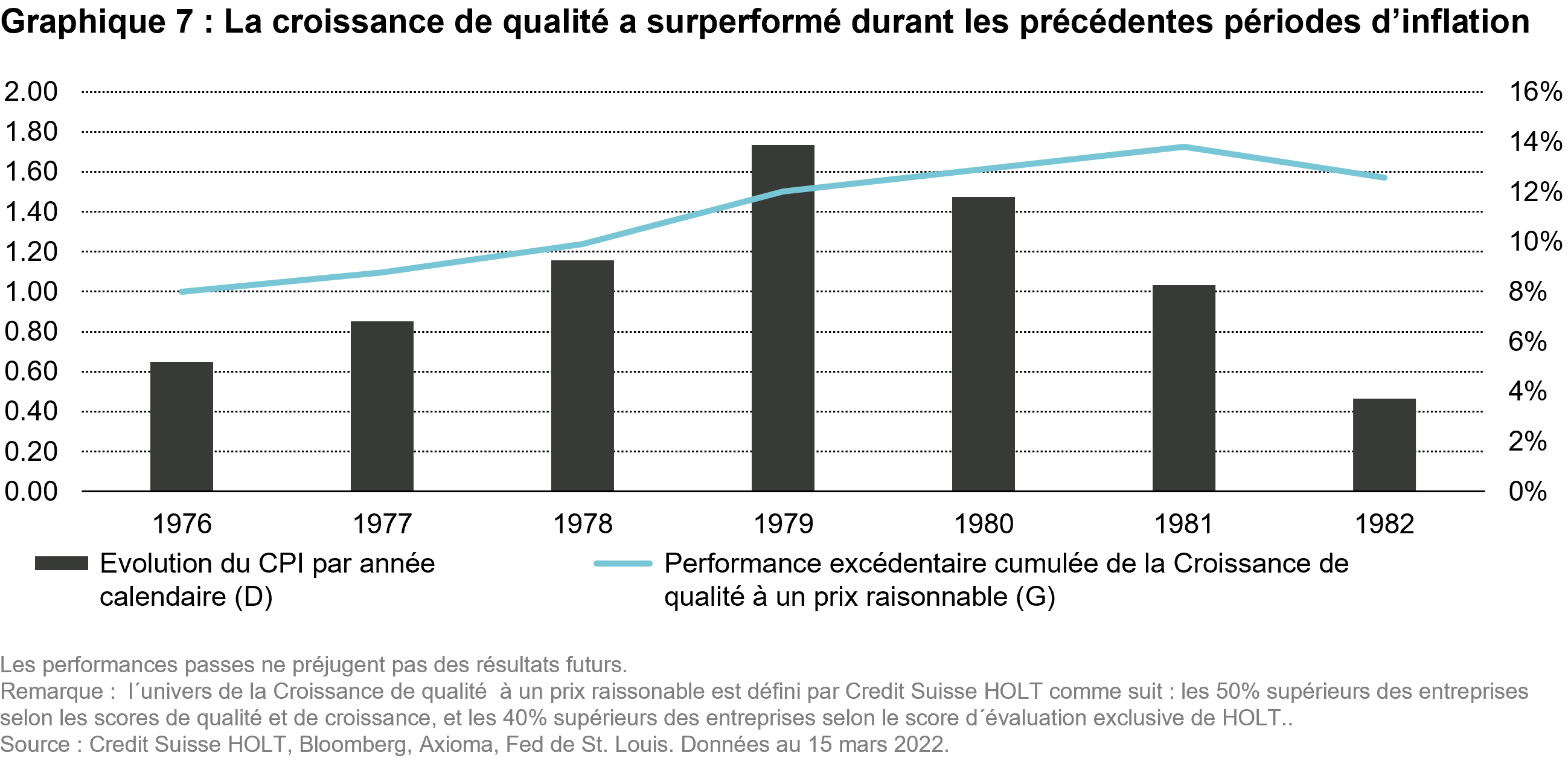

Bénéficiant de marges plus élevées, les entreprises de qualité devraient être moins affectées si l’inflation persiste. Entre 1976 et 1982, une période de forte inflation, les actions de qualité ont ainsi surperformé le marché de 800 pb en moyenne (graphique 7).

Conclusion

Depuis un an environ, la question de savoir si l’économie américaine connaîtra un atterrissage brutal ou un atterrissage en douceur a fait couler beaucoup d’encre parmi experts des médias et de Wall Street. Nous ne sommes pas en mesure de prédire le scénario que nous réservent les mois à venir. En revanche, nous savons que la protection du capital dans les marchés baissiers est extrêmement importante pour la performance à long terme. Le calcul est simple. Si votre investissement a chuté de 50%, vous devrez doubler votre capital pour revenir à la position initiale. Plus vous limitez les pertes, plus vous accumulez de capital sur une longue période.

Comme le souligne notre récent livre blanc, intitulé Construction de portefeuille : une formule « pas si secrète », nous veillons systématiquement à investir dans des entreprises que nous comprenons. Plutôt que fonder nos décisions d’investissement sur des analyses macroéconomiques ou nous bercer d’illusions sur notre capacité à prévoir le prix des matières premières, nous sélectionnons des actions et construisons des portefeuilles en privilégiant la protection contre la baisse.

Par David Souccar, Portfolio Manager, Senior Research Analyst, Vontobel Asset Management

Pour accéder au site, cliquez ICI.

Disclaimer :

Les investissements évoqués ne sont pas forcément détenus par l’une de nos stratégies et sont fournis à des fins d’illustration uniquement. Il ne saurait être garanti que Vontobel réalisera des investissements ayant des caractéristiques identiques ou similaires à celles des investissements présentés. Les investissements sont présentés exclusivement à des fins de discussion et ne constituent pas un indicateur fiable de la performance ou du profil d’investissement d’un indice composite ou d’un compte client. De plus, le lecteur ne doit pas présumer que les investissements identifiés ont été ou seront fructueux ou que les recommandations d’investissement ou les décisions d’investissement que nous prendrons à l’avenir seront rentables.

Certaines des informations figurant dans cet article s’appuient sur des déclarations, des informations ou des opinions prospectives, y compris des descriptions de changements anticipés du marché et des prévisions quant à l’activité future. Vontobel estime que ces déclarations, informations et opinions sont fondées sur des estimations et des hypothèses raisonnables. Toutefois, les déclarations, informations et opinions prospectives sont par nature incertaines et les événements ou résultats réels peuvent différer sensiblement de ceux qui figurent dans les déclarations prospectives. Par conséquent, il convient de ne pas accorder une confiance excessive à ces déclarations, informations et opinions prospectives.