Retrouvez le commentaire de Christophe Morel, chef économiste chez Groupama AM.

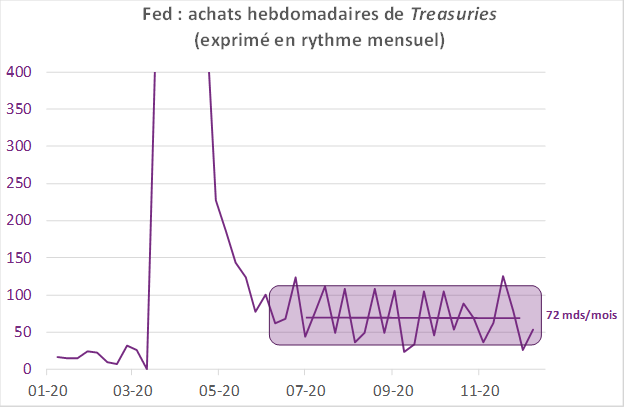

1. A l’issue du FOMC, la Fed a maintenu sa politique d’achat d’actifs inchangée contrairement à notre anticipation d’un allongement de la duration. Deux arguments semblent justifier cette décision : d’une part, les banquiers centraux américains ont révisé à la hausse leur perspective sur la croissance (désormais, la Fed est en ligne avec notre scénario sur 2020 et légèrement en-dessous pour 2021) ; d’autre part, les annonces sur les vaccins les ont conduit à réviser la balance des risques sur la croissance qui est passée du statut « à la baisse » à celui « d’équilibrée » (les annexes sur les prévisions comportent désormais des graphiques sur l’appréciation par les banquiers centraux des incertitudes et de la balance des risques). En pratique, la Fed s’engage à acheter « au moins 80 milliards/mois de dette d’État », ce qui suppose toutefois de relever légèrement le rythme mensuel moyen qui s’établit plutôt à 70 mds/mois (cf. graphique). Les commentaires de J. Powell lors de la conférence de presse suggèrent qu’il faudrait que la balance des risques soit à nouveau « à la baisse » pour que la Fed accentue sa politique d’achat d’actifs.

2. Conformément à notre anticipation, la Fed a précisé une « forward guidance » sur sa politique monétaire non conventionnelle. Elle maintiendra le rythme actuel d’achats « jusqu’à ce que des progrès substantiels aient été réalisés en direction des objectifs d’emploi et d’inflation ». Au regard des prévisions de la Fed sur le taux de chômage (il est attendu à 5.0% fin 2021 et 4.2% fin 2022 ce qui s’approche du niveau d’équilibre), nous en déduisons que la Fed envisage de maintenir la politique actuelle d’achat d’actifs jusqu’en 2022.

3. J. Powell n’a pas semblé inquiet des niveaux de valorisation sur les marchés d’actions. Il reconnaît que les ratios de P/E sont très élevés, mais peuvent se justifier dans un environnement de taux d’intérêt durablement bas.

4. Au final, la politique d’achats d’actifs est sans doute plus liée aux évolutions sur le taux de chômage alors que la trajectoire sur le taux directeur dépend davantage des évolutions attendues sur l’inflation sous-jacente. A priori, la chronique de politique monétaire que pourrait avoir actuellement en tête la Fed est la suivante : i) annoncer le « tappering » sur le QE au T3-21 ; ii) démarrer le « tappering » au printemps 2022 ; iii) ne pas remonter les taux directeurs avant 2024 sachant qu’en 2023, l’inflation ne sera toujours pas « modérément au-dessus de 2.0% ». Nous pensons toujours que les achats d’actifs dureront plus longtemps, à savoir jusqu’à fin 2022, et ce pour trois raisons :

Pour accéder au site, cliquez ICI.