Après plusieurs mois à tenir la bride des marchés en leur répétant à l’envi que les chiffres d’inflation nécessitaient une politique restrictive, la BCE vient cette semaine de baisser les taux de 0.25% passant ainsi le taux de refinancement à 4.25% et le taux de dépôt, celui qui impacte directement les investisseurs, à 3.75%. Si cette action était relativement consensuelle, voire quasi annoncée par certains membres de l’institution il y a quelques jours, nous ne pouvions rédiger notre hebdo sans en dire quelques mots. Mais nous les limiterons au minimum, ayant déjà couvert le sujet en long et en large durant les mois passés, pour conclure il y a quelques semaines que les marchés s’étaient, enfin, alignés sur la BCE et avaient, à raison, tempéré leurs anticipations.

Matthieu Bailly, Président Directeur Général d'Octo AM

Matthieu Bailly, Président Directeur Général d'Octo AM

Et si les marchés sont alignés avec la réalité, les prix et les taux sont à peu près en ligne et rien n’a vocation à se produire à la suite de cette annonce ; ce d’autant plus que la BCE a bien pris soin de souffler à la fois le chaud et le froid pour éviter tant que possible tout emballement créant des à-coups de volatilité à la suite de ses annonces, comme ce fut le cas entre la fin 2023 et le début 2024.

Assez logiquement donc, Madame Lagarde entamait hier sa conférence en annonçant la baisse de taux puis passait le reste de son temps à justifier une politique restant plutôt restrictive et « data dependent » pour les mois à venir : aucun engagement sur des baisses de taux à venir, patience, surveillance de l’inflation et de la croissance, voire poursuite de la réduction du bilan, ce qui aura vocation à maintenir une pression à la hausse sur les taux longs.

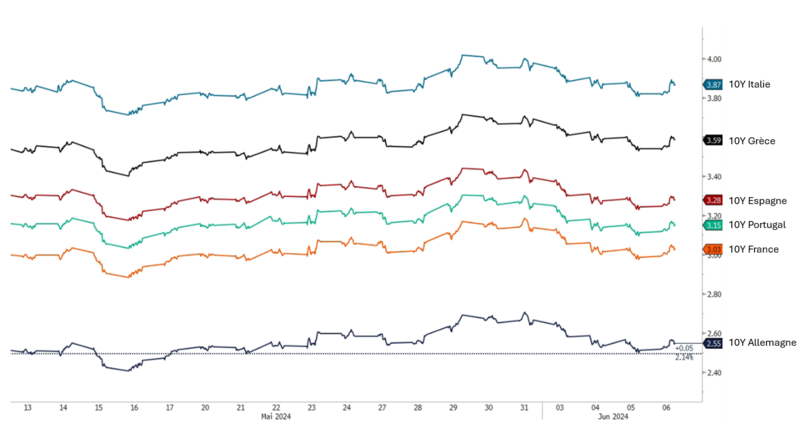

Alors bien sûr, on a pu observer quelques soubresauts sur les futures taux dans l’après-midi mais rien comparé à ce qu’on pouvait subir lors, par exemple, des dernières publications de statistiques d’inflation aux USA ou de hausses de salaires en Europe, comme en témoigne le graphe ci contre sur les rendements d’Etats européens sur le mois écoulé.

Rendements des Etats Européens

(Sources : Bloomberg, Octo AM)

Nous concluerons donc ce point avec quatre lignes directrices pour les semaines à venir :

-

Une duration plutôt plus longue qu’elle ne pouvait l’être au premier semestre, du fait du changement de tendance sur la politique monétaire, de la désinversion progressive de la courbe et de l’augmentation des risques micro et géopolitiques

-

Un maintien de la flexibilité sur cette duration, un rally pouvant se produire du fait de flux importants sur les obligations longues, comme on avait pu le voir fin 2023, qui s’expliqueraient notamment par une bascule de certains investisseurs des produits monétaires et très court terme (dont le rendement va assez rapidement baisser) vers des maturités plus longues

-

Une réduction progressive du risque de crédit « high yield », moins rémunérateur qu’il ne l’était en 2023 en relatif et en absolu

-

Le maintien d’une surpondération sur les financières : les taux plus élevés plus longtemps sont favorables aux comptes de résultats bancaires, tout comme la repentification progressive de la courbe par la baisse des taux courts, qui leur offre plus de marge de manœuvre pour leur activité de transformation. Rappelons ici qu’un des leviers bancaires est d’emprunter à court terme pour prêter à long terme.

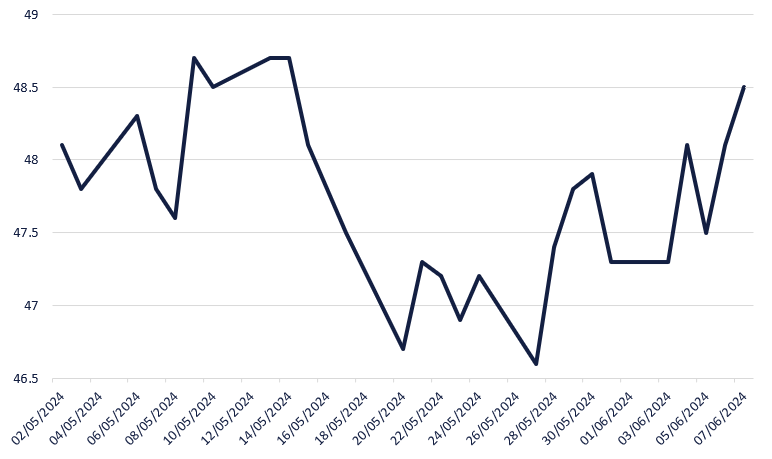

Un autre évènement se produisait également cette semaine, tout aussi neutre pour les marchés à court terme : la dégradation de la notation de l’Etat Français par S&P. Ici encore, ayant déjà beaucoup abordé le sujet au cours de nos hebdos précédents, notamment celui du 26/04, nous nous contenterons d’un graphe et d’une conclusion pour parler de ce non-évènement :

Spread 10Y Allemand – 10 Y France

(Sources : Bloomberg, Octo AM)

Les notations d’agences ne font que formaliser une situation déjà acquise tandis que les marchés financiers tentent d’anticiper ; il est donc logique que les prix ne bougent pas une fois la notation modifiée dans la mesure où c’est plutôt une fois la dérive de la France face à ses pairs sur une période de plusieurs années actée dans les spreads de crédit, que les agences de notation matérialisent cette situation dans leur notation.

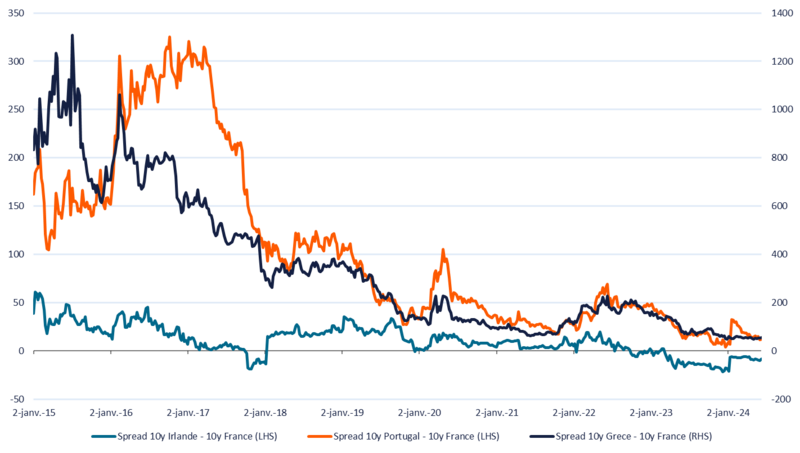

Spread 10Y Irlande – Portugal – Grèce / 10Y France

(Sources : Bloomberg, Octo AM)

L’échelle de temps des Etats est autrement plus longue que celle des marchés et la tendance actuelle de la France en termes de finances publiques et de gestion économique par le pouvoir politique est à peu près la même que celle d’il y a 10, 20 et 30 ans… , et plus généralement l’Eurozone, bénéficient cependant de trois facteurs puissants qui permettent à l’Etat d’emprunter sur des niveaux raisonnables de taux :

-

La BCE et la réglementation bancaire et assurantielle, qui offre aux Etats Européens la capacité de vendre leurs obligations à des investisseurs acquis, ad vitam, à leur cause : la BCE parce que sa première mission est la stabilité de la Zone, les investisseurs institutionnels parce qu’ils sont tenus fermement par le bras par la régulation, pilotée par la BCE elle-même…

-

Le statut de « Zone sûre et fiable » de l’Europe pour les investisseurs étrangers, qui peuvent placer leurs capitaux sereinement en cas de crise ou d’inquiétude dans leur propre pays. Deux zones dans le monde offrent cette sécurité avec suffisamment de profondeur de capitaux investissables : les USA et l’Europe. Cette sécurité se paie et permet à l’Euro et aux Etats de conserver une prime vis à vis de pays plus incertains, en particulier le monde émergent.

-

La relativité : l’endettement est une notion qui se compense et qui se juge de manière relative. Si la France a considérablement gonflé son endettement sur les dernières années, la plupart des pays, dont l’Allemagne et les USA, l’ont fait aussi… La prime de la France est donc restée relativement stable vis-à-vis des autres et son « degré de fiabilité » relatif pour placer ses capitaux l’est resté aussi.

-

Situation de l’Europe et de la France va continuer de se dégrader dans les termes de l’échange : l’inflation va se poursuivre du fait des matières premières importées, du change (lié à l’endettement des Etats et au faible dynamisme économique), des pressions sociales pour l’augmentation des salaires, de la transition écologique (plus coûteuse que dans beaucoup de zones géographiques), l’économie va sous-performer les autres zones du monde, l’endettement relatif va continuer de grimper, l’appauvrissement relatif aux autres zones va se poursuivre (du fait des éléments précédents). Il est donc tout à fait probable que la notation de la France et des autres pays d’Europe basculent progressivement vers le BBB dans les décennies à venir, tandis que beaucoup d’émergents le deviendront aussi et sortiront des catégories « spéculatives »… à moins que les agences ne révisent leur référentiel…

Une semaine qui vient donc quasiment conclure ce premier semestre de gestion dans le calme et permettra aux gérants de réaliser, dans le même calme, quelques bascules des fonds monétaires vers les fonds obligataires afin de profiter d’un portage supérieur et d’une courbe dont la pente se normalise progressivement, rassurés par une banque centrale devenue, ce 6 juin, leur alliée pour les mois à venir.

Article redigé par Matthieu Bailly, Président et Directeur Général délégué d'Octo AM

Publié également sur le site d'Octo AM

A PROPOS D’OCTO AM

Créée en 2011 à l’initiative d’Octo Finances et adossée au groupe Amplegest depuis 2018, Octo AM est spécialiste de la gestion obligataire ‘value’. S’adressant essentiellement aux investisseurs professionnels, qu’ils soient institutionnels ou patrimoniaux, Octo AM décline sa gestion au travers de fonds ouverts, fonds dédiés ou mandats avec un objectif permanent : rechercher les obligations offrant, selon le gérant, un rendement supérieur à son risque de crédit sur un horizon donné.

Pour accéder au site d'OCTO AM, cliquez ICI.