Depuis quelque temps, les inquiétudes ESG relatives au changement climatique, à la sécurité de l’eau et à la pollution plastique monopolisent les ondes ; mais il serait faux de penser que la controverse des expérimentations animales est enterrée.

Malgré les interdictions et les restrictions, selon les estimations1 , 10 millions d’animaux subiraient chaque année des expérimentations douloureuses. Tout ceci au profit de l’humanité et au nom de la cosmétique et de la recherche médicale. Certes, des expériences demeurent nécessaires dans certains domaines jusqu’à la découverte de meilleures méthodes, mais pas dans la majorité des cas. Un jour viendra où ces pratiques barbares ne seront plus acceptables et seront remplacées par les progrès rapides de la technologie et de la science. Hélas, ce jour n’est pas encore venu. Mais la situation a évolué depuis les années 1990 et les autorités de réglementation se sont emparées du problème.

En 1993, l’Union européenne fut la première région au monde à interdire les expérimentations animales pour les produits cosmétiques et elle demeure aujourd’hui encore la référence dans ce type de réglementation. L’Inde, Israël, la Norvège et la Suisse, entre autres, ont également interdit les expériences sur les animaux dans ce secteur. Aux Etats-Unis, si cette pratique n’est pas obligatoire pour les cosmétiques, elle n’est pas non plus interdite. D’autres pays sont en retard, et si des expérimentations animales sont requises pour un seul marché de commercialisation, ce sont tous les progrès extérieurs qui sont alors réduits à néant.

Il n’existe pas jusqu’à présent de moratoire européen, et encore moins international, relatif à l’utilisation des animaux par la science. En réalité, dans le cadre de la pandémie de Covid-19, de nombreux membres de la communauté médicale ont interpelé les autorités de réglementation mondiales afin qu’elles reconsidèrent l’importance des expérimentations animales, jugées essentielles pour faire avancer la santé humaine et vétérinaire et ainsi sauver des vies.

Dans le camp adverse, on trouve des personnalités comme le comédien et fervent défenseur des droits des animaux Ricky Gervais, devenu récemment membre de la Humane Society International afin d’offrir une nouvelle visibilité à ce sujet brûlant. La campagne portée par le court-métrage d’animation mettant en scène le lapin Ralph a été conçue pour sensibiliser le grand public et a touché des cordes sensibles. La controverse fait rage.

Ces progrès offrent un éclairage sur l’avenir, et fournissent une raison supplémentaire d’abandonner les expérimentations animales grâce à des résultats plus rapides et plus précis. Car au-delà des questions éthiques, le problème récurrent de l’utilisation d’animaux pour les tests en laboratoires provient des différences de réaction avec un être humain, notamment dans le domaine de la toxicologie. Les perspectives de changement s’améliorent toujours en présence d’une incitation d’ordre économique.

Ces progrès offrent un éclairage sur l’avenir, et fournissent une raison supplémentaire d’abandonner les expérimentations animales grâce à des résultats plus rapides et plus précis. Car au-delà des questions éthiques, le problème récurrent de l’utilisation d’animaux pour les tests en laboratoires provient des différences de réaction avec un être humain, notamment dans le domaine de la toxicologie. Les perspectives de changement s’améliorent toujours en présence d’une incitation d’ordre économique.

Réglementation et avancées en Chine

L’un des principaux obstacles à l’abandon des expérimentations animales est la lenteur du changement réglementaire. Les autorités se montrent souvent prudentes, jusqu’à hésiter parfois à prendre trop de risque sur le plan personnel. Parmi les freins les plus importants aux progrès de la réglementation, citons l’exigence chinoise de tester sur des animaux tous les produits cosmétiques importés. A la suite de négociations sans relâche entre des représentants gouvernementaux, de nombreux grands groupes de biens de consommation et des ONG, les autorités chinoises ont cependant annoncé que la vente de la plupart des « cosmétiques généraux » importés (shampooing, rouge à lèvre et maquillage, par exemple) ne serait plus soumise à cette obligation. Cette nouvelle règle est entrée en vigueur en mai 2021. Elle n’interdit pourtant pas les expérimentations pour tous les types de cosmétiques, puisque les produits à usage spécifique, comme les crèmes solaires et les teintures capillaires, devront toujours être testés. Mais l’important ici est que cette avancée majeure est due au succès d’actions de lobbying. Grâce à celles-ci, de nombreuses marques non testées sur les animaux vont pouvoir pénétrer sur le marché chinois.

Pour autant, les nouvelles réglementations n’ont pas mis un terme définitif aux pratiques d’expérimentations animales. C’est pourquoi les entreprises qui ont recours à de telles techniques doivent prendre conscience du fait qu’elles risquent de leur côté une mise à l’épreuve ultime de leur image. Celle-ci peut être ternie si l’opinion publique perçoit les valeurs de l’entreprise comme défaillantes et que des ONG incisives s’en servent comme exemples des plus mauvaises pratiques. Les entreprises testant leurs produits sur des lapins et autres créatures à fourrure sont des cibles faciles.

Quelles sont les entreprises exposées ?

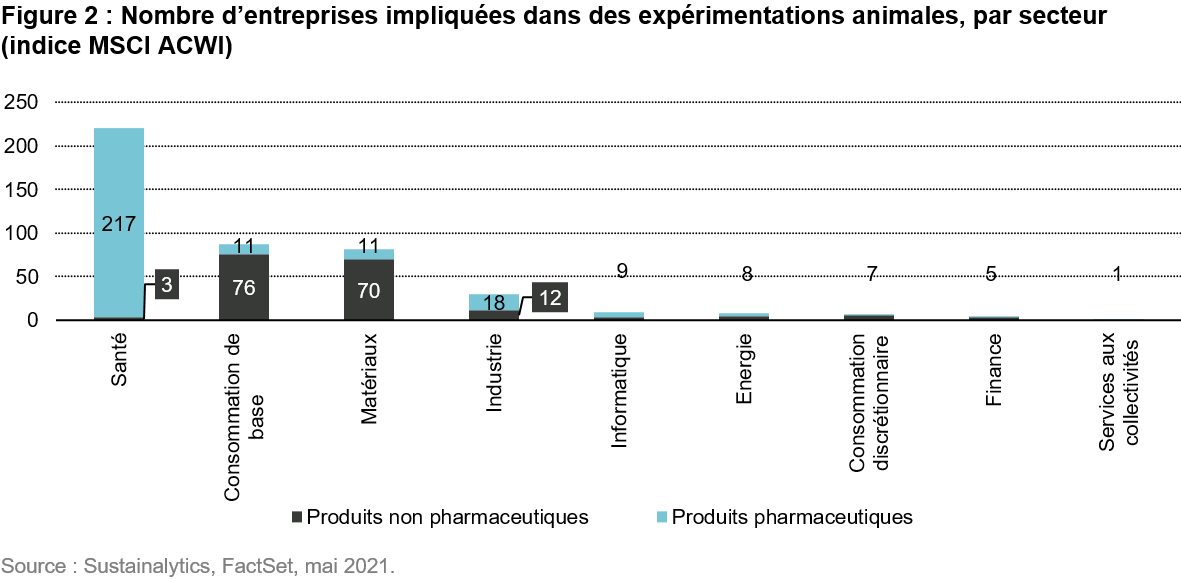

Nos données sur l’implication des entreprises dans les expérimentations animales ont été fournies par Sustainalytics. La figure ci-dessous représente 448 entreprises de l’indice MSCI All Country World (MSCI ACWI) qui sont impliquées dans ce genre de pratiques. Sans surprise, les chiffres dénotent une importante concentration sectorielle. Neuf entreprises sur dix proviennent de quatre secteurs différents, et un peu moins de la moitié des soins de santé. Les activités concernées se divisent entre les produits pharmaceutiques (60% du total) et les autres articles. Les pays les plus représentés sont les Etats-Unis (23% du total), la Chine (20%) et le Japon (15%), en raison du poids important des secteurs de la santé dans leur économie (et leur marché boursier). A noter qu’environ un cinquième des entreprises désignées entrent dans la catégorie des « soupçons d'implication », ce qui signifie que leur transparence est insuffisante mais qu’elles opèrent dans des secteurs où les tests sur animaux sont répandus.

Il est important de souligner que les produits pharmaceutiques ont un impact sur la santé humaine par le biais de composants utilisés dans les médicaments et les appareils médicaux. Souvent, les autorisations de mise sur le marché nécessitent la réalisation de tests de sécurité impliquant la plupart du temps des animaux de laboratoire. Certains de ces produits sont utilisés par de nombreuses personnes, de telle sorte que les avantages de tests de sécurité efficaces peuvent être considérables. Compte tenu de son utilité publique, le secteur est strictement réglementé. Cependant, il existe de nombreuses technologies qui, à long terme, permettront certainement d’éliminer le besoin de recourir à la majorité des expérimentations animales :

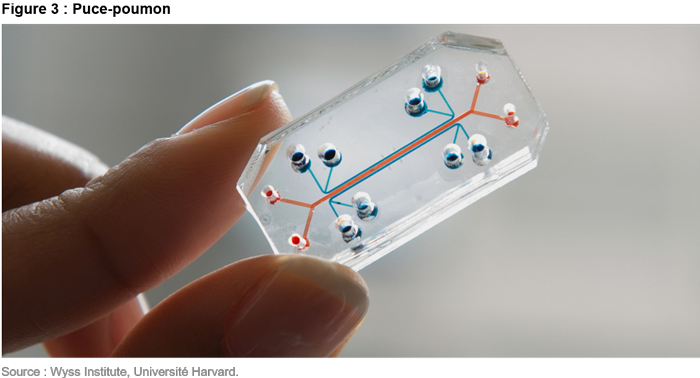

par exemple, des appareils répliquant la réaction de l’organisme humain, comme les organes sur puce2 issus des recherches de l’Université Harvard et de l’European Organ-on-Chip Society, ou encore la capture tissulaire sur puce3 de l’U.S. National Center for Advancing Translational Sciences (NCATS). La rapidité du développement des vaccins à ARNm de Moderna et Pfizer/BioNTech, qui, pour des questions d’urgence, ont été testés simultanément sur des humains et sur des animaux, illustre parfaitement l’importance du progrès technologique.

Des tests de sécurité sont également employés pour des ingrédients et des produits chimiques utilisés dans la fabrication d’aliments et de cosmétiques, mais également d’adhésifs industriels, de peintures ou de pesticides. Les produits chimiques industriels peuvent être dangereux et nécessitent de ce fait une réglementation rigoureuse, impliquant parfois des tests sur animaux. L’univers des cosmétiques est généralement considéré comme un domaine plus accessible pour moderniser la réglementation, car celle-ci est moins stricte aux Etats-Unis et dans l’Union européenne, qui sont d’importants marchés, tandis que ses ingrédients relèvent souvent de différentes règles. Pour les multinationales confrontées à l’opinion publique, l’enjeu est qu’en dépit des réglementations locales, la perception des consommateurs, elle, est internationale. Même pour un seul marché, les expérimentations animales demeurent des expérimentations animales.

Echanges avec les équipes de direction

Nous avons reproduit ci-dessous quelques-uns de nos échanges avec des entreprises au sujet des tests sur animaux. Concernant les explications fournies par les équipes dirigeantes, notre première observation est que les expérimentations animales restent un sujet sensible, pour lequel les exigences de transparence sont rares. Deuxième observation : la majorité des entreprises rappellent les objectifs 3R initialement fixés par l’UE4 en matière de protection des animaux utilisés à des fins scientifiques :

- Replace : remplacer le recours aux animaux par d’autres méthodes

- Reduce : réduire le nombre d’animaux utilisés dans les expérimentations

- Refine : améliorer les procédures afin de réduire les contraintes imposées aux animaux.

Le fabricant américain d’équipements et de fournitures de santé Boston Scientific a recours aux tests sur animaux à des fins de recherche et de développement, ainsi que pour se conformer à ses obligations réglementaires. Il déploie dans la mesure du possible des solutions alternatives, notamment les tests in vitro et ex vitro (non conduits sur des animaux), les cadavres humains et les simulations informatiques et synthétiques. Les dirigeants de Coca Cola ont souligné que des tests sur animaux, effectués par des tiers, étaient nécessaires pour vérifier la sécurité des ingrédients et des additifs sur certains marchés. Là encore, des alternatives sont utilisées pour démontrer la sécurité des produits lorsque cela est possible.

La multinationale Unilever, spécialiste des biens de consommation (cosmétiques, aliments, boissons et produits d’entretien ménager), a reconnu que sa production et celle de certains partenaires de la chaîne d’approvisionnement étaient soumises à des exigences de tests sur animaux à des fins de sécurité des produits sur certains marchés, notamment la Russie et la Chine. L’entreprise a pris publiquement position en faveur de l’arrêt des expérimentations animales et soutient la campagne de la Humane Society International visant à modifier la réglementation en la matière. Un dialogue a été initié avec des responsables et des personnalités politiques, et l’entreprise a signé la lettre ouverte appelant l’Agence européenne des produits chimiques à revenir sur ses exigences de tests sur animaux.

Pour le groupe français LVMH, dont l’activité couvre les vêtements de luxe, les boissons et les cosmétiques, les exigences d’expérimentations animales ont principalement affecté les ventes de produits de beauté des marques Guerlain, Givenchy et Dior en Chine. L’entreprise possède son propre département de toxicologie in vitro, qui teste les matières premières et les ingrédients en interne à l’aide d’alternatives aux animaux de laboratoire. LVMH collabore également avec les autorités chinoises pour encourager la modification des règles applicables aux importations.

L’entreprise de produits chimiques antiparasitaires Rentokil Initial présente un profil moins typique, de par son activité de contrôle des nuisibles dans les immeubles commerciaux et résidentiels. Le contrôle des nuisibles réduit les risques de propagation de maladies aux populations humaines et évite des dégâts dans les immeubles. Rentokil a recours à des expérimentations animales pour pouvoir vendre ses produits raticides : la plupart des marchés sur lesquels est présente l’entreprise exigent des analyses démontrant l’efficacité des raticides, insecticides, répulsifs ou appâts, à la fois dans le cadre d’études contrôlées en laboratoire et dans des conditions de terrain réalistes. L’entreprise déclare qu’elle cherche à employer des outils plus humains dans la mesure du possible, et a cité une amélioration des normes régissant les pièges à rongeurs. A noter qu’à l’heure où nous écrivons, cette entreprise est notée AA par MSCI ESG.

Synthèse

Les pratiques d’expérimentation animale sont indésirables. Les dizaines d’années de campagnes acharnées d’ONG de protection des droits des animaux très incisives ont laissé des traces durables dans l’opinion des consommateurs et les valeurs des entreprises. Aujourd’hui, une vaste coalition réunissant des entreprises, des ONG et des juristes à l'avant-garde cherche à imposer des alternatives. Heureusement, la technologie est aussi de la partie. Sur un horizon certes encore éloigné, les progrès de l’IA et de la science de la simulation portent les plus grands espoirs pour enterrer définitivement ces méthodes.

1. https://www.rspca.org.uk/adviceandwelfare/laboratory

2. https://wyss.harvard.edu/media-post/lung-on-a-chip/

3. https://ncats.nih.gov/files/Tissue-Chip-factsheet.pdf

4. https://ec.europa.eu/environment/chemicals/lab_animals/legislation_en.htm

Disclosure

The discussion of any investments in this paper is for illustrative purposes only and there is no assurance that the adviser will make any investments with the same or similar characteristics as any investments presented. The investments identified and described do not represent all of the investments purchased or sold for client accounts. The representative investments discussed were selected based on topics related to our ESG research. The reader should not assume that an investment identified was or will be profitable. There is no assurance that any investments identified will remain in client accounts at the time you receive this document.

Certain information ©2021 MSCI ESG Research LLC. This report contains “Information” sourced from MSCI ESG Research LLC, or its affiliates or information providers (the “ESG Parties”). The Information may only be used for your internal use, may not be reproduced or redisseminated in any form and may not be used as a basis for or a component of any financial instruments or products or indices. Although they obtain information from sources they consider reliable, none of the ESG Parties warrants or guarantees the originality, accuracy and/or completeness, of any data herein and expressly disclaim all express or implied warranties, including those of merchantability and fitness for a particular purpose. None of the MSCI information is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such, nor should it be taken as an indication or guarantee of any future performance, analysis, forecast or prediction. None of the ESG Parties shall have any liability for any errors or omissions in connection with any data herein, or any liability for any direct, indirect, special, punitive, consequential or any other damages (including lost profits) even if notified of the possibility of such damages.

Part of this publication may contain Sustainalytics proprietary information that may not be reproduced, used, disseminated, modified nor published in any manner without the express written consent of Sustainalytics. Nothing contained in this publication shall be construed as to make a representation or warranty, express or implied, regarding the advisability to invest in or include companies in investable universes and/or portfolios. The information is provided "as Is" and, therefore Sustainalytics assumes no responsibility for errors or omissions. Sustainalytics cannot be held liable for damage arising from the use of this publication or information contained herein in any manner whatsoever.

© 2021 Vontobel Asset Management, Inc. All Rights Reserved.

Pour accéder au site, cliquez ICI.