L’inflation a été le thème dominant sur les marchés financiers en 2021, et nous pensons qu’elle devrait redevenir un moteur important des rendements en 2022.

Dans son analyse annuelle des prévisions d’investissement de 46 des plus grandes banques d’investissement et sociétés de gestion d’actifs au monde, Bloomberg News a constaté que le mot « inflation » revenait 224 fois. Le mot COVID n’y figurait que 36 fois. L’étude conclut que « la flambée des prix plane sur presque tous les scénarios envisagés » par les stratèges en 2022.

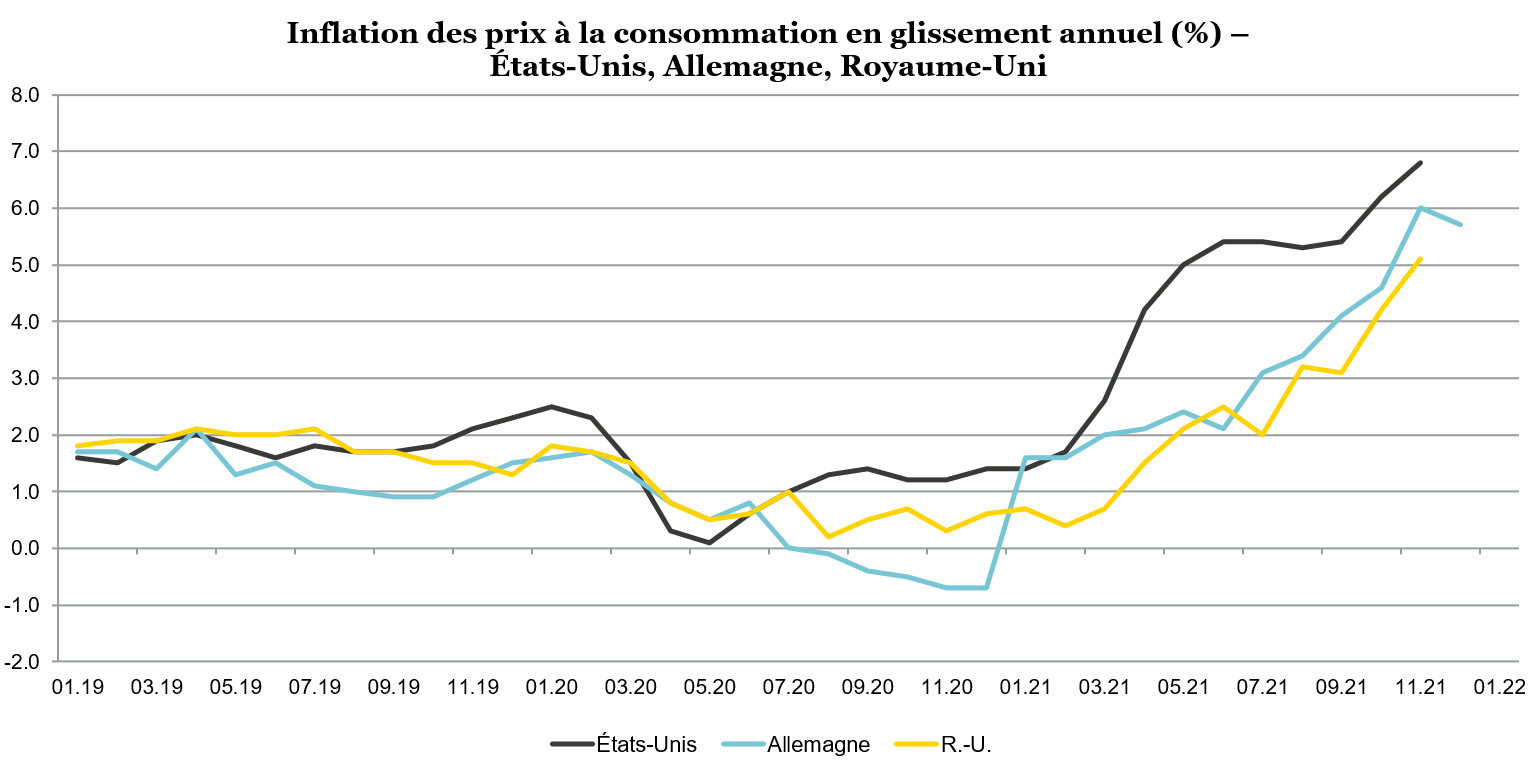

Le débat sur le degré de « transition » de l’inflation au moment où les économies mondiales émergeaient des arrêts induits par la COVID en 2020 a dominé les marchés en 2021, mais à la fin de l’année, les données semblaient avoir mis un terme à cette discussion. En novembre, l’inflation des prix à la consommation (IPC) aux États-Unis a atteint 6,8 %, sa septième lecture mensuelle consécutive supérieure à 5 %, tandis que l’IPC au Royaume-Uni a atteint son plus haut niveau en dix ans à 5,1 % et l’IPC allemand a grimpé à 5,2 %, son plus haut niveau depuis 1992.

Source : TwentyFour, Bloomberg, 10 janvier 2022

La maxime bien connue selon laquelle « l’inflation nuit aux obligations » repose en partie sur le fait que l’inflation érode la valeur des coupons et du principal que les détenteurs d’obligations à taux fixe recevront à l’avenir. En termes de gestion de portefeuille, le défi le plus pertinent d’une hausse de l’inflation est qu’elle a tendance à provoquer des hausses de taux d’intérêt susceptibles d’avoir des répercussions sur tout, qu’il s’agisse des bons du Trésor américain ou des obligations à haut rendement et des marchés émergents.

Il ne fait aucun doute que l’inflation nuit à certaines obligations. Mais pour les gérants de fonds actifs à revenu fixe, qui disposent d’un marché obligataire mondial comptant plus de 120 billions1 de dollars, il existe quelques tactiques qui, selon nous, peuvent contribuer à atténuer l’impact de l’inflation, et nous percevons actuellement un certain nombre d’opportunités qui, selon nous, peuvent permettre aux investisseurs de prospérer dans cet environnement.

1. Maintenir la duration basse

La principale inquiétude au sein du revenu fixe à propos de l’inflation tient généralement au fait qu’elle est synonyme de pertes sur les marchés des taux tels que les bons du Trésor américain qui, à leur tour, peuvent entraîner des pertes sur les produits de crédits, lorsque l’écart est trop faible pour absorber la faiblesse des taux.

Les investisseurs ont reçu un rappel brutal de ce risque au cours de la toute première semaine de 2022, lorsque les rendements des bons du Trésor américain à 10 ans ont atteint leur plus haut niveau en neuf mois, à 1,73 %, après que les procès-verbaux de la réunion de décembre de la Fed ont laissé entendre que les hausses de taux pourraient survenir plus tôt que prévu par les marchés. À notre avis, cette histoire ne fait que commencer ; avec un taux de chômage aux États-Unis tombé à 3,9 % en décembre et une inflation atteignant son plus haut niveau depuis 40 ans, les conditions d’un resserrement de la politique monétaire de la Fed sont clairement réunies et il ne reste plus qu’une marge de manœuvre très étroite à la banque centrale.

Par conséquent, notre première stratégie pour vaincre l’inflation par les obligations consiste à maintenir la duration basse. Nous pouvons y parvenir en partie par la constitution du portefeuille, en évitant complètement les obligations d’État à long terme et en détenant des taux à court terme uniquement à des fins de liquidité, par exemple, mais, étant convaincus de la hausse des courbes de rendement, nous pensons qu’il est judicieux de couvrir l’exposition aux taux par un swap de taux d’intérêt, le cas échéant, étant donné son coût relativement faible. Notre courbe de couverture privilégiée serait la GBP, compte tenu des faibles coûts de portage et de notre prévision d’une hausse des rendements des Gilt à 10 ans à 1,40 % d’ici la fin de l’année. Nous estimons que la courbe de l’euro constituerait, certes, une alternative de qualité, mais pas aussi convaincante.

2. Examiner les obligations à taux variable

Pour les investisseurs en titres obligataires à long terme, il n’existe pas de couverture parfaite contre l’inflation, car il est impossible d’éliminer complètement le risque de duration d’un portefeuille (autrement dit, si vous souhaitez toujours détenir des actifs susceptibles de vous procurer un rendement). Les emprunts d’État indexés sur l’inflation, tels que les TIPS américains, ne sont pas aussi efficaces qu’il n’y paraît, et si les swaps tactiques de taux d’intérêt peuvent, comme indiqué précédemment, offrir un certain niveau de protection contre la hausse des courbes de rendement, ils doivent être envisagés avec prudence car ils peuvent rapidement devenir la position dominante d’un portefeuille.

En conséquence, notre deuxième stratégie consiste à examiner les obligations à taux variable, qui n’ajoutent pas de risque de taux d’intérêt à un portefeuille, car leurs coupons augmentent parallèlement à chaque hausse des taux de base. Cela devrait favoriser les prêts à effet de levier, tout comme l’ensemble du marché européen des titres adossés à des actifs (ABS). Pour les investisseurs cherchant à tirer parti de ces deux secteurs, les obligations européennes adossées à des prêts (CLO) constitueraient l’une de nos meilleures sélections de 2022, les meilleurs résultats étant susceptibles de se trouver en bas du spectre de notation. Selon nous, les CLO européennes notées BB pourraient ainsi générer un rendement de près de 7 % cette année, découlant principalement du portage élevé offert ici.

3. Mettre l’accent sur le rendement et le roll-down

La stratégie numéro trois consiste à mettre l’accent sur le rendement et le roll-down. Le rendement peut être l’une de nos armes les plus efficaces contre l’inflation, car il permet d’amortir un portefeuille contre l’impact corrosif de la hausse des taux, tandis que le roll-down (la compression naturelle des écarts qui se produit lorsque les obligations approchent de l’échéance) peut atténuer considérablement le risque de duration dans un portefeuille.

Il est bien connu que le rebond incessant des actifs à risque depuis le pire de la crise de la COVID-19 il y a environ 18 mois a rendu les rendements de nombreux secteurs des titres à revenu fixe chers par rapport aux cours historiques, mais les fondamentaux du crédit paraissant extrêmement solides, nous pensons que cela se justifie et nous percevons encore des niches de valeur à cibler.

La dette subordonnée des banques, et plus particulièrement la dette Tier 1 supplémentaire (AT1) émise par les banques européennes, fait également partie de nos meilleures sélections de 2022. Les banques sont généralement plus immunisées contre l’inflation que d’autres secteurs et elles ont tendance à bénéficier de la hausse des taux d’intérêt. Le secteur a également démontré sa résilience pendant la crise de 2020, les banques ayant conservé et même augmenté leurs fonds propres en dépit de conditions économiques difficiles. Nous pensons qu’actuellement, il existe de nombreux établissements bien capitalisés dont les obligations AT1 offrent des rendements sains. À l’heure actuelle, de nombreux établissements bien capitalisés disposent d’obligations AT1 proposant des rendements que nous considérons comme sains ; par exemple, s’ils arrivaient sur le marché maintenant, nous attendrions un rendement de près de 5 % pour une transaction AT1 notée BBB avec un appel de fonds à cinq ans d’une banque notée A.

Nous pensons également que les obligations d’entreprises des marchés émergents en devises fortes ont le potentiel de surperformer nettement cette année, car les prévisions indiquent que la croissance et les bénéfices rattraperont ceux des marchés développés. Il convient toutefois d’émettre une réserve au sujet de cette opportunité qui pourrait s’évaporer rapidement si la Fed s’engage dans un cycle de resserrement plus agressif que celui qu’elle a communiqué ; nous avons affirmé que ce n’était pas une opération du premier trimestre dans nos perspectives annuelles, et la réaction du marché aux procès-verbaux de la Fed a peut-être déjà validé ce point de vue. Toutefois, l’indice des obligations à haut rendement des marchés émergents dégageant un rendement de 7,4 %2, nous pensons qu’il devrait y avoir des opportunités pour les investisseurs patients et capables de choisir le bon moment.

Pour ce qui est du roll-down, il s’agit d’une tactique défensive qui, selon nous, est mieux utilisée lorsque les marchés sont bien valorisés, généralement en milieu ou fin de cycle. Au début d’un cycle économique, lorsque la plupart des actifs semblent peu chers par rapport aux moyennes historiques, nous visons normalement les obligations à plus longue échéance pour bénéficier de meilleurs rendements à plus long terme. Or, le crédit semble maintenant se situer en milieu de cycle et, sur les 18 derniers mois, les courbes de crédit se sont aplaties à l’extrémité longue. Alors que nous approchons de la prochaine étape de ce cycle en progression rapide, nous assistons à la pentification de l’extrémité courte à mesure que les hausses de taux sont prises en compte, et prévoyons donc que les obligations à plus courte échéance (en particulier celles de la fourchette de trois à cinq ans) offriront aux investisseurs le plus de gains de roll-down. Toutefois, il importe de souligner que le ciblage de ce roll-down sur l’extrémité courte de la courbe n’est réellement efficace que si vous achetez des obligations présentant un écart suffisant pour absorber les hausses de taux anticipées.

Pour accéder au site, cliquez ICI.