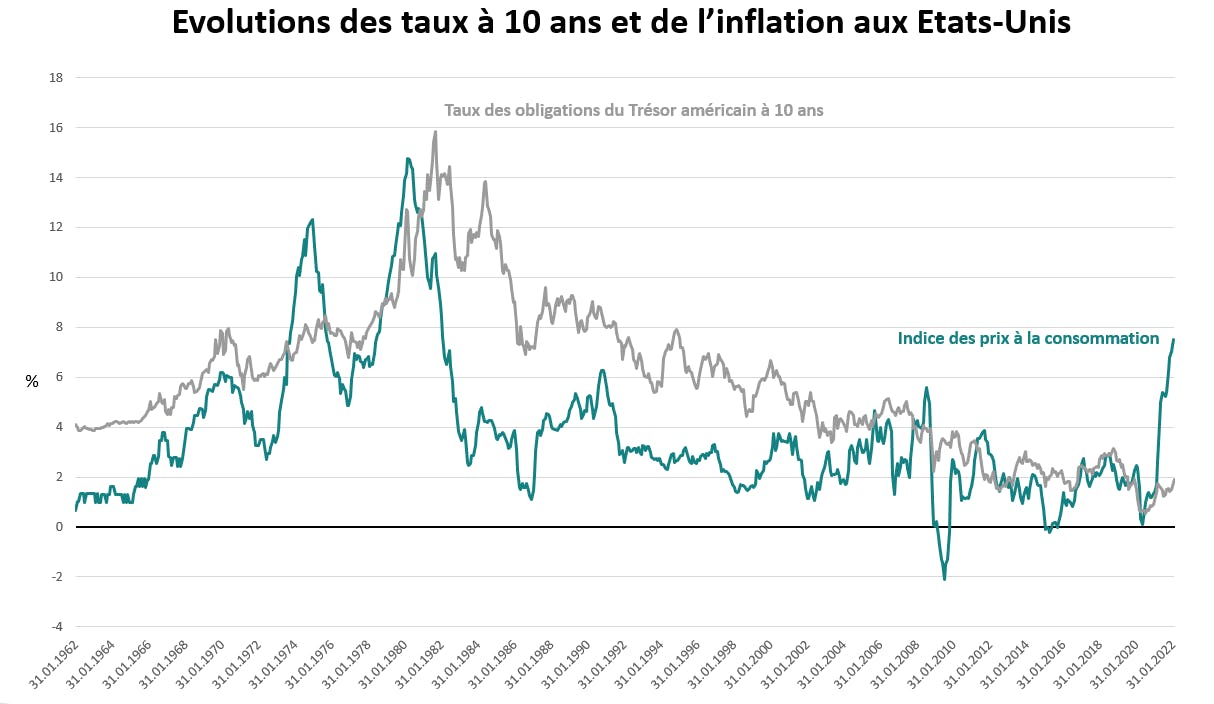

2022 démarre sous le signe de l’inflation après tant d’années où son absence immuable faisait d’une part craindre l’installation d’une déflation ravageuse et laissait d’autre part beaucoup de liberté aux banques centrales.

Depuis plus d’une décennie, l’atonie persistante de l’activité économique couplée à l’absence de dynamisme sur le front des prix permettait dès que besoin aux instituts d’émission de soutenir l’activité par des baisses de taux d’intérêt à court terme ou des achats d’actifs obligataires pesant, eux, à la baisse sur les taux à maturités plus éloignées (Quantitative Easing). Les banques centrales et les marchés – par les attentes qu’ils exprimaient ou les excès qu’ils commettaient –

« choisissaient » la politique monétaire à mettre en œuvre, sans autre contrainte que leurs propres besoins.

C’était l’époque où les mauvaises nouvelles économiques – plus nombreuses que les bonnes - se traduisaient en bonnes nouvelles pour les marchés car elles conduisaient à tous coups les banques centrales à injecter des liquidités, ce carburant des marchés à l’indice d’octane le plus élevé. Mais ça, c’était avant. Et, comme nous l’avions envisagé il y a plusieurs mois, c’est désormais l’inflation qui, après sa longue éclipse, « décide » de la politique monétaire.

Les banquiers centraux n’ont plus d’autre choix que de se plier aux exigences de l’inflation. Les banques centrales ont en effet un mandat précis auquel elles ne peuvent durablement déroger. Dans ce mandat, la stabilité des prix occupe une place centrale ; transiger avec l’inflation, c’est se mettre hors la loi.

Ce retour de l’inflation comme déterminant premier des politiques monétaires produit deux conséquences principales. La première est que l’incertitude sur le niveau des taux d’intérêt futurs augmente sensiblement, au gré des à-coups de la politique monétaire, forcée de dérouler en temps réel le fil tortueux de l’inflation. La volatilité des marchés obligataires va donc se renforcer et, avec elle, celle des marchés d’actions.

Les tentatives de décisions de politique monétaire « téléphonées » aux marchés pour en amortir l’impact immédiat seront souvent vouées à l’échec. L’évolution de la communication de la Réserve fédérale américaine (Fed) depuis sa découverte bizarrement tardive de la persistance de l’inflation en novembre dernier ou, plus récemment encore, celle de la Banque centrale européenne (BCE) par la voix de sa présidente Christine Lagarde, l’a d’ailleurs illustré de manière caricaturale.

Passer comme elles l’ont fait d’une position de déni à l’égard de l’inflation future à des annonces de hausses de taux possiblement nombreuses enrichies ou non d’une réduction rapide de leur portefeuille d’obligations (Quantitative Tightening) n’est qu’un signe avant-coureur de l’imprévisibilité déstabilisante de l’inflation et de la difficulté à la juguler en suivant un processus continu, normé. La volatilité est de retour !

"C’est de nouveau l’inflation qui décide de la politique monétaire !"

La seconde conséquence du comeback de l’inflation est que pour respecter leur mandat, les banques centrales peuvent être amenées à retirer de la liquidité alors même qu’un ralentissement se profile ou se développe. Et selon toute vraisemblance, ce serait ce vers quoi l’on tend aux Etats-Unis aujourd’hui et, peut-être, en Europe demain.

Source : Bloomberg

La conjoncture américaine présente en effet un dilemme majeur pour la Fed : un ralentissement du rythme de croissance économique de plus de 5 % aujourd’hui vers un plus modeste 2 % au dernier trimestre 2022 alors que l’inflation resterait jusqu’en mars au-dessus des 7 % pour ensuite redescendre vers un toujours trop robuste 3 % en fin d’année. Cette configuration économique justifie un resserrement monétaire pour s’assurer d’une inflation suffisamment proche de l’objectif des 2 %.

Ce resserrement, dans un contexte long terme où le consensus de marché ne croit ni à une inflation durablement très éloignée de sa cible ni à une croissance durablement vigoureuse, sera vécu comme anxiogène (40 ans de désinflation et plus de 20 années de croissance atone sont passées par là). Certains vont crier à l’erreur de politique monétaire, d’autres au risque de retour des pressions déflationnistes.

Ce scepticisme à l’égard de l’inflation peut avoir un effet important que la banque centrale américaine pourrait vouloir corriger : la multiplication des relèvements des taux directeurs sera très vraisemblablement accompagnée d’une moindre remontée des taux longs (aplatissement de la courbe des taux) compte tenu des craintes d’amplification induite de la baisse de l’inflation à moyen terme et du rythme de l’activité économique. Pour faire simple, les marchés continuent de penser que la réaction de la Fed suffira à casser les anticipations d’inflation et de croissance et maintiennent donc les taux à long terme sur des niveaux relativement bas.

Cette situation pourrait ne pas convenir à la Réserve fédérale, qui considérerait alors que la remontée réduite des taux à long terme pourrait rendre sa politique de resserrement inopérante. La Fed a en effet notamment besoin de refroidir le marché immobilier qui présente de nombreux signes de surchauffe. Ce marché est sensible aux taux à long terme que la Fed voudra voir monter suffisamment pour le ralentir.

Le marché de l’immobilier résidentiel est en effet devenu de plus en plus spéculatif aux Etats-Unis avec la participation croissante d’investisseurs en recherche de rendement, au grand dam des accédants à la propriété contraints de courir après la hausse des prix du « pied carré ». Cette situation nous amène à croire que l’arme de la réduction du bilan de la banque centrale américaine sera utilisée dès cette année car elle a un effet direct sur les taux à long terme.

"La situation américaine sera déterminante pour la politique monétaire européenne"

Peut-être le président de la Réserve fédérale Jerome Powell, dans sa brutale volte-face, a-t-il aussi considéré que ce cycle économique n’est pareil à nul autre ? Le resserrement monétaire intervient en effet à un moment où les agents économiques sont dans une situation financière favorable permise par les soutiens budgétaires et monétaires massifs mis en œuvre pour faire face aux effets du Covid, capables de rendre les consommateurs moins vulnérables à un resserrement monétaire.

Cependant, nous ne saurions balayer d’un revers de la main le scepticisme du consensus de marché à l’égard de la soutenabilité de l’inflation américaine. Les craintes déflationnistes qui ont animé les marchés au cours de la décennie passée sont encore très présentes malgré l’épisode inflationniste que traverse l’économie mondiale aujourd’hui. La perspective du retour de l’inflation vers 2,5 % dans les deux ans est crédible, même si elle ne semble pas incorporer quelques inflexions structurelles potentiellement inflationnistes comme le prix de l’énergie, la réduction du taux d’épargne pour cause démographique ou les relocalisations industrielles programmées.

A plus court terme, si le ralentissement attendu de l’économie a un effet plus marqué qu’anticipé sur l’inflation, l’ampleur du resserrement monétaire attendu pourrait être progressivement revue à la baisse d’autant qu’il nous semble que la Fed voudra conserver une partie du retard qu’elle a pris en la matière, dans la mesure du possible. Nous ne sommes donc pas à l’abri d’une bonne surprise sur le front monétaire mais ce n’est pas notre scénario de base.

Quant à Christine Lagarde, qui préside aux destinées monétaires de l’Europe, son radical et récent changement de ton ouvre la voie à un possible resserrement monétaire dès cette année. Dès lors, on pourra rechercher la teneur de la « Révélation » qui a entraîné sa fraîche conversion, dès l’instant où l’essentiel de l’inflation européenne aujourd’hui a une cause extérieure sur laquelle la BCE n’a aucune prise : les prix de l’énergie.

Anticipe-t-elle de vindicatives négociations salariales à travers le Vieux Continent qui conduiraient l’Europe vers la dynamique inflationniste américaine à l’œuvre depuis près d’un an ? La crainte semble fondée. Méfions-nous de l’eau qui a dormi trop longtemps mais gardons d’abord un œil attentif sur la situation américaine qui sera déterminante pour la politique monétaire européenne.

L’année qui commence promet assurément d’être volatile, passionnante et pleine d’opportunités. Une de ces années pleines de défis et de retournements, plus en phase avec notre vocation de gérant actif que ces millésimes monolithiques où la performance est le résultat frustrant d’une banale et unique décision : rester investi, passivement.

Par Frédéric Leroux, Responsable Équipe Cross Asset, Gérant

Pour en savoir plus, cliquez ICI.

Ce document ne peut être reproduit, en tout ou partie, sans autorisation préalable de la société de gestion. Il ne constitue ni une offre de souscription, ni un conseil en investissement. Les informations contenues dans ce document peuvent être partielles et sont susceptibles d’être modifiées sans préavis. L’accès au fonds peut faire l’objet de restriction à l’égard de certaines personnes ou de certains pays. Il ne peut notamment être offert ou vendu, directement ou indirectement, au bénéfice ou pour le compte d’une «U.S. person» selon la définition de la réglementation américaine «Regulation S» et/ou FATCA.

Le fonds présente un risque de perte en capital. Les risques et frais sont décrits dans le DICI/KIID (Document d’Information Clé pour l’Investisseur). Le prospectus, DICI/KIID, et les rapports annuels du fonds sont disponibles sur le site www.carmignac.com et sur demande auprès de la société de gestion. Le DICI/KIID doit être remis au souscripteur préalablement à la souscription. La société de gestion peut décider à tout moment de cesser la commercialisation dans votre pays. Les investisseurs peuvent avoir accès à un résumé de leurs droits en français sur le lien suivant à la section 6 intitulée "Résumé des droits des investisseurs" : https://www.carmignac.fr/fr_FR/article-page/informations-reglementaires-3862. En Suisse : Le prospectus, le KIID, et les rapports annuels du fonds sont disponibles sur le site www.carmignac.ch et auprès de notre représentant en Suisse (Switzerland) S.A., Route de Signy 35, P.O. Box 2259, CH-1260 Nyon. Le Service de Paiement est CACEIS Bank, Paris, succursale de Nyon / Suisse Route de Signy 35, 1260 Nyon. Le KIID doit être remis au souscripteur préalablement à la souscription.Les investisseurs peuvent avoir accès à un résumé de leurs droits en français sur le lien suivant à la section 6 intitulée "Résumé des droits des investisseurs" : https://www.carmignac.ch/fr_CH/article-page/informations-reglementaires-1789

Pour visiter le site, cliquez ICI.