Avec le retour de l’inflation, un défi considérable se dresse devant les investisseurs obligataires en cette année 2022.

Les banques centrales, qui semblent enfin commencer à prendre au sérieux les pics d’inflation enregistrés, inédits depuis des décennies, ont fait volte-face et adopté une approche agressive. Les marchés intègrent les quatre relèvements des taux prévus par la BCE d’ici la fin de l’année, ainsi que les cinq relèvements de la Banque d’Angleterre et les sept de la Fed. L’invasion de l’Ukraine par la Russie a non seulement accru la pression inflationniste, mais aussi introduit un risque de ralentissement économique, voire même de récession, et a fait soufflé un vent inquiétant de volatilité sur les marchés obligataires.

Les investisseurs obligataires se trouvent ainsi dans la position peu enviable de devoir gérer les effets d’érosion de capital résultant de la hausse des taux et les difficultés d’une évaluation au prix du marché dans un contexte de volatilité. Nous sommes de l’avis que les investisseurs doivent, dans un tel environnement, s’intéresser aux risques d’une duration excessive.

La hausse des taux et le problème de la duration

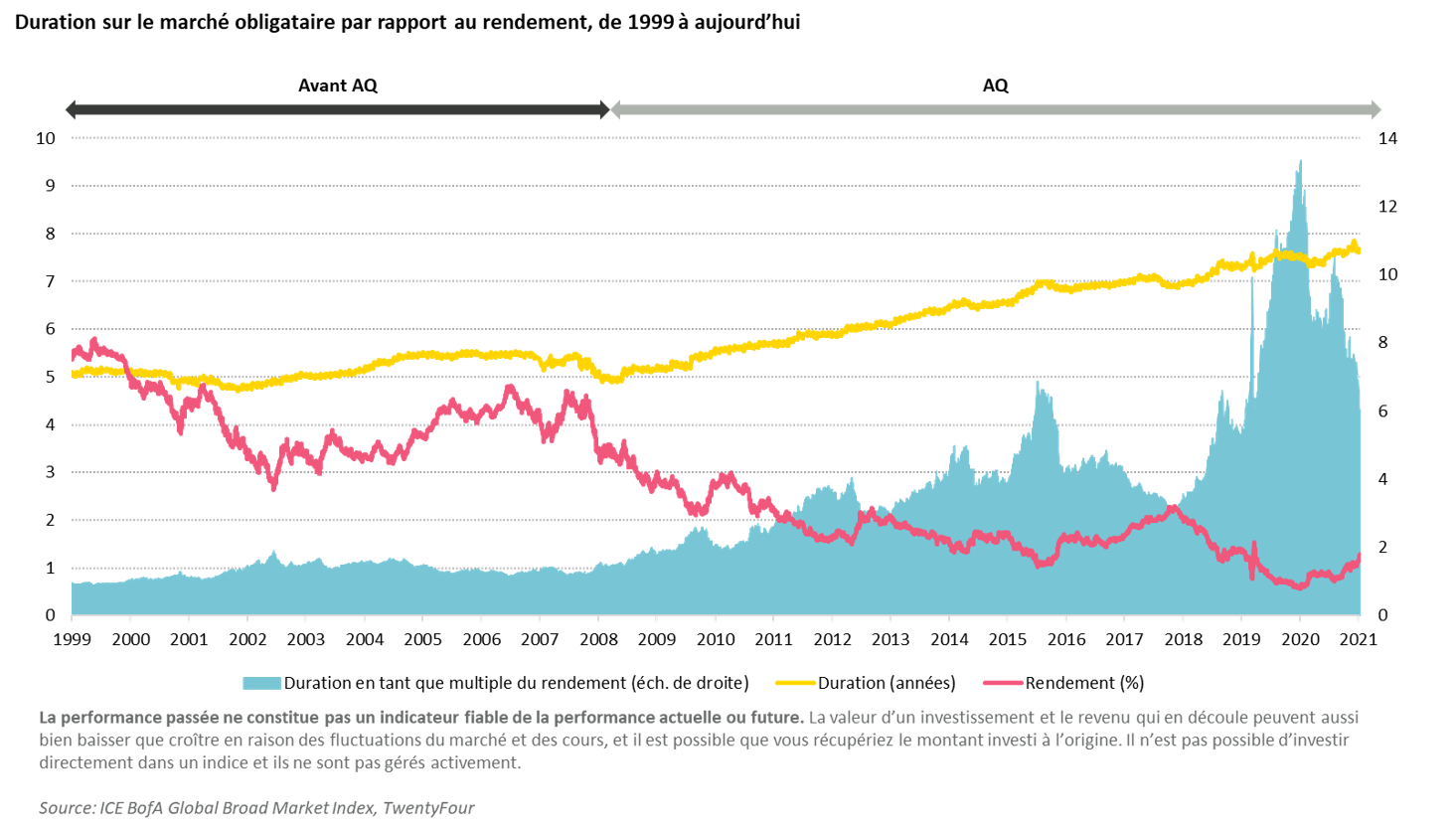

Les banques centrales discutent activement de l’accélération du resserrement quantitatif (RQ) dans le cadre de leurs efforts pour mettre un terme aux mesures de relance et réduire leurs bilans. Ces considérations pourraient sonner le glas d’un élément essentiel du soutien apporté aux actifs à risque au cours des deux derniers cycles économiques. Ainsi que l’illustre le graphique ci-dessous, la mise en œuvre de l’assouplissement quantitatif (AQ) au lendemain de la crise financière mondiale a provoqué la chute des rendements moyens sur fond d’augmentation constante de la duration moyenne (qui mesure la sensibilité des obligations aux taux d’intérêts), entreprises et gouvernements prolongeant les échéances et tirant parti de la baisse des coûts de financement.

Un écart a fini par se creuser dans le rapport entre le risque, sous forme de duration, et la récompense, sous forme de rendement.

Ce rapport s’est récemment quelque peu rétabli et nous sommes de l’avis que la diminution de l’écart entre duration et rendement devrait se poursuivre au cours des prochains mois. Toutefois, à mesure que les taux d’intérêts et les rendements augmentent, la présence d’un degré élevé de duration dans un portefeuille obligataire pourrait entraîner des pertes de capital considérables, notamment dans le cadre de stratégies limitées à des obligations à taux fixe, dont les durations sont longues et les rendements faibles.

La protection offerte par les obligations à court terme

Nous pensons que les portefeuilles constitués d’obligations à duration courte essentiellement investment grade peuvent résoudre quelques-unes des principales difficultés auxquelles les investisseurs sont confrontés dans l’environnement de marché actuel.

Il est cependant peu probable qu’investir de manière purement mécanique dans des obligations à brève échéance soit la meilleure stratégie pour affronter la volatilité des marchés. Nous savons par expérience que l’optimisation des rendements ajustés au risque dépend en grande partie de la manière dont le fonds en obligations à court terme est constitué.

Nos recherches ont permis de déterminer qu’en limitant à moins de 100 le nombre de positions obligataires individuelles (afin de permettre de l’alpha sur la sélection des titres) et en investissant principalement dans des obligations d’entreprises notées BBB ayant des échéances inférieures à cinq ans (afin de cibler un rendement plus intéressant), il était possible de constituer un portefeuille d’obligations à court terme qui soit en mesure de protéger les investisseurs des effets les plus préjudiciables de la duration et de la volatilité des marchés. En effet, nous avons constaté que ce principe demeure valable également en périodes de hausses multiples des taux d’intérêt, le rendement et le roll-down de la courbe de rendement typiques obtenus à l’aide de ce type de stratégie dépassant souvent l’ampleur des pertes de capital caractéristiques de périodes d’extrême tension.

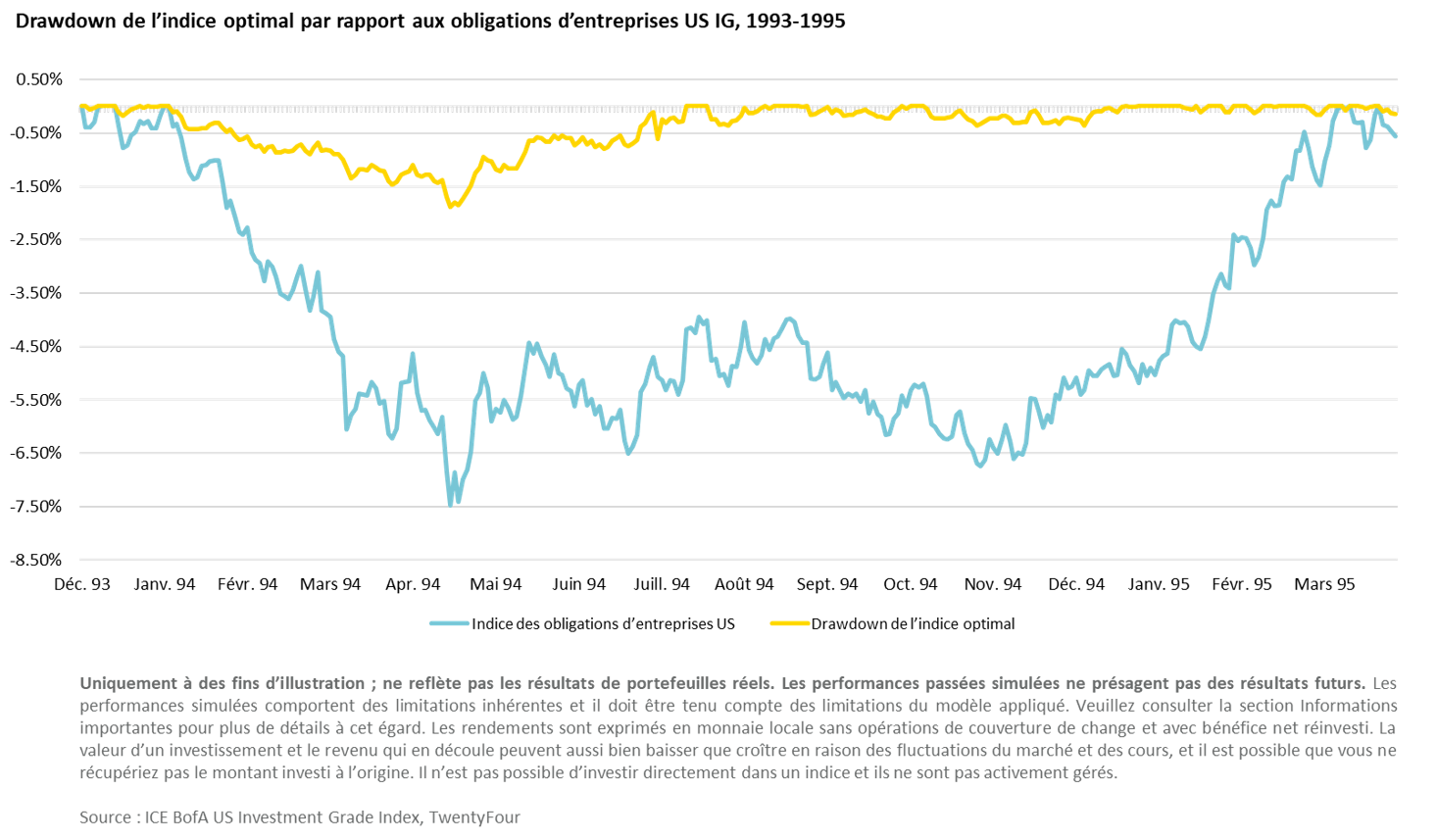

En 1994 par exemple, la Fed a dépassé en permanence les attentes du marché et a mis en œuvre l’équivalent de dix hausses de taux, portant le taux de fonds fédéraux à un pic de 6 %.

Le graphique ci-dessus représente le drawdown de l’indice des obligations d’entreprises investment grade américaines (ligne bleue) et un indice optimal théorique construit et géré conformément aux contraintes énoncées ci-dessus (ligne jaune), pour la période couvrant l’année 1994 et le début de l’année 1995. Il indique que, sur cette période, notre indice théorique d’obligations à court terme aurait subi des reculs bien moindres et aurait manifesté une volatilité plus faible que les marchés des obligations d’entreprises américaines en général. En fait, cet indice aurait pu enregistrer des rendements positifs en dépit des hausses de taux d’intérêts subies d’un total de 250 pb1.

Malgré quelques différences entre les conditions qui prévalaient en 1994 et les conditions actuelles, nous pensons que les avantages naturels des obligations à court terme peuvent atténuer certains risques majeurs auxquels les investisseurs seront confrontés en 2022.

Les avantages naturels des obligations à court terme

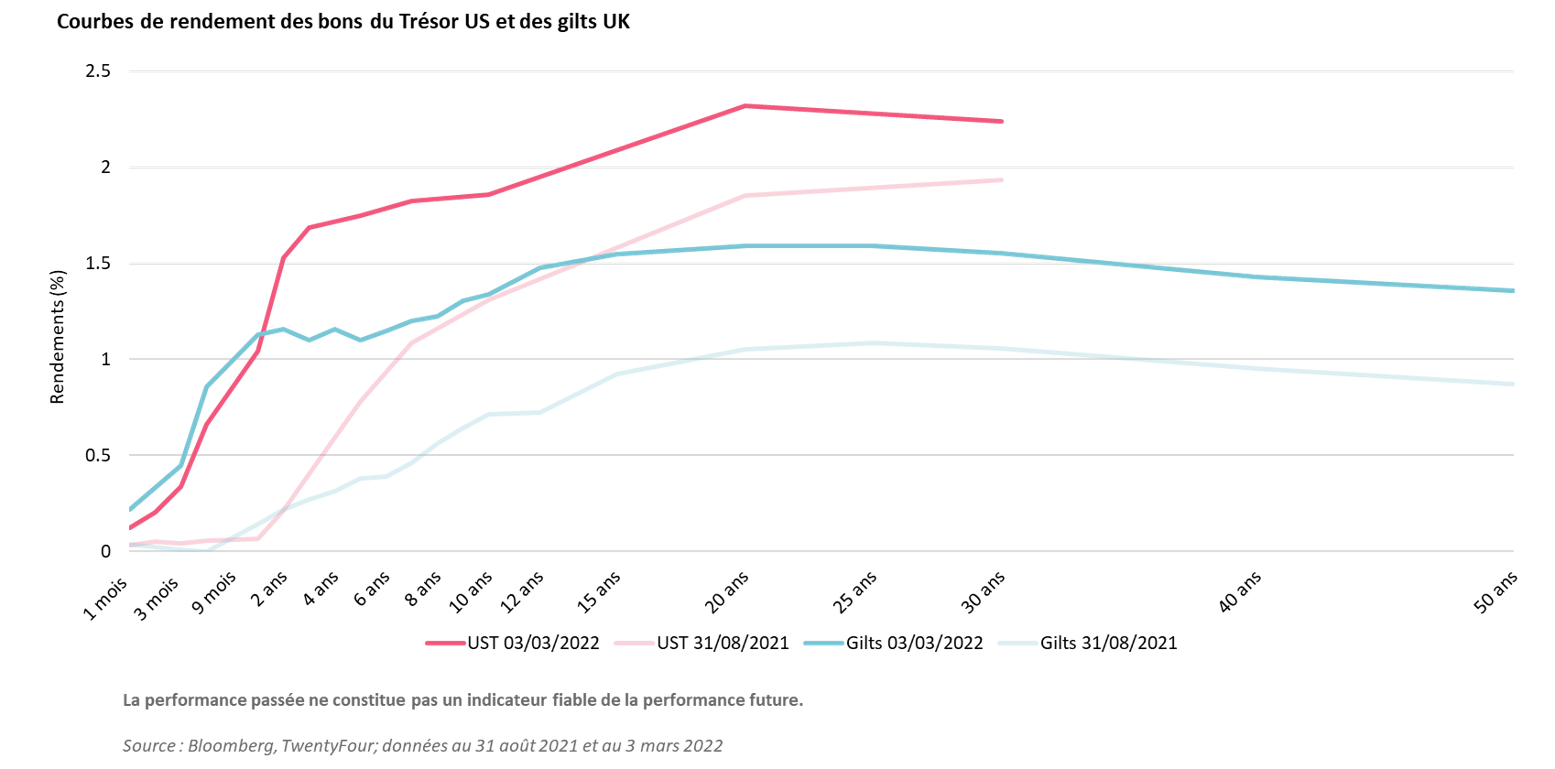

L’un de ces avantages et le « roll-down ». Le roll-down est le gain en capital généré par le recul naturel du rendement d’une obligation lorsqu’elle approche de son échéance. Plus la courbe est prononcée, plus le potentiel de gains dus au roll-down est élevé, étant donné que le rendement de l’obligation continue à baisser (générant un gain en capital plus important) à l’approche de l’échéance. Le potentiel de roll-down est généralement bien plus élevé pour les obligations à court terme que pour celles à échéances plus longues, car les courbes de rendement ont tendance à être bien plus prononcées sur leur segment à court terme.

Comme l’illustre le graphique ci-dessous, le début de la courbe de rendement des emprunts d’État américains et britanniques est actuellement particulièrement prononcée. Elle a en effet enregistré une évolution très marquée au cours des six derniers mois, lorsque les investisseurs ont commencé à intégrer les hausses de taux multiples aussi bien de la Fed que de la Banque d’Angleterre. Au-delà des quatre ans pour les emprunts américains et des deux ans pour les emprunts britanniques, les courbes s’aplatissent au point que le potentiel de roll-down supplémentaire associé à l’achat d’une obligation à plus long terme est annulé par le risque de duration supplémentaire pris en optant pour cette option.

Le potentiel de gains dus au roll-down est par ailleurs généralement plus élevé avec des obligations d’entreprises à courte échéance que des emprunts d’État, les courbes des obligations d’entreprises ayant tendance à demeurer prononcées tout au long des cycles du marché et à offrir bien entendu aux investisseurs un rendement supérieur pour un risque de duration équivalent. Les bons du Trésor américains générant actuellement plus de 2 %, les obligations d’entreprises américaines investment grade à deux ans pourraient offrir plus de 3 %, ce qui est à notre avis une perspective intéressante étant donné le potentiel de ces dernières à générer des gains de roll-down et leur absence relative de duration.

Un autre avantage naturel des obligations à court terme, notamment celles ayant une échéance à environ 12 mois, est l’effet «pull-to-par». L’effet «pull-to-par» reflète le fait qu’à mesure qu’une obligation approche de sa date d’échéance, elle tire («pull») vers sa valeur nominale («par»), le risque de défaut devenant de plus en plus négligeable et le prix au comptant de l’obligation s’amortissant à 100. Les investisseurs détenant des obligations à longue échéance ne profitent pas de cet effet «pull», étant donné que la date d’échéance est trop éloignée pour fournir le même degré de certitude quant au remboursement du principal et au niveau général de rendements des marchés. Il est important de noter que l’effet «pull-to-par» intervient que l’obligation soit négociée à escompte ou qu’elle soit négociée à prime, les deux étant remboursées à hauteur de 100 dans un cas comme dans l’autre.

Enfin, les échéances à court terme offrent aux stratégies en obligations à court terme la possibilité d’améliorer le rendement, ce qui est effectué en appliquant quelques stratégies distinctes. Tout d’abord, dans un environnement de rendements à la hausse, tels que celui que nous vivons actuellement, une allocation importante à des obligations assorties d’une échéance à 12 mois ou moins a pour conséquence que la stratégie en obligations à court terme engrange des remboursements réguliers de principal, qui peuvent être réinvestis à rendements plus élevés. Les investisseurs détenant des obligations à longue échéance devront attendre bien plus longtemps pour pouvoir réinvestir et pourraient devoir recourir à la vente d’actifs (qui pourrait entraîner des pertes de capital et étaler les coûts) pour accélérer le processus.

Ensuite, les stratégies en obligations à court terme tenteront d’optimiser le rendement du portefeuille en procédant à des allocations à forte conviction à des actifs certes plus risqués, mais assortis d’échéances extrêmement courtes, dont le risque de défaut a été considérablement réduit, mais le rendement demeure relativement élevé par rapport à des actifs traditionnellement moins risqués. Nous observons par exemple actuellement de nombreuses opportunités d’obligations d’entreprises hybrides à brève échéance et d’obligations bancaires subordonnées, pouvant dégager des rendements de plus de 6 % pour des échéances de seulement deux ans.

À eux seuls, ces avantages naturels des obligations à court terme ne peuvent pas garantir des rendements positifs. En revanche, ils fournissent aux investisseurs dans le revenu fixe la possibilité de se protéger contre d’éventuelles pertes de capital tout en préservant le revenu et, à notre avis, peuvent offrir aux gestionnaires, plus que ne le peuvent les stratégies à longues échéances, une base solide pour optimiser les rendements des portefeuilles par le biais de l’allocation des actifs et de la sélection des titres.

Étant donné la double pression exercée par l’inflation et la volatilité, nous pensons que les atouts inhérents aux stratégies en obligations à court terme peuvent rassurer les investisseurs en cette période incertaine du cycle.

1. TwentyFour, modélisation réalisée en mars 2022

Par Chris Bowie, Partner, Portfolio Manager

Pour accéder au site, cliquez ICI.