A noter : Voici une nouvelle lettre de Muzinich & Co « Commentaire de Marché Hebdomadaire » reprenant l’essentiel de l’actualité économique et des marchés du crédit.

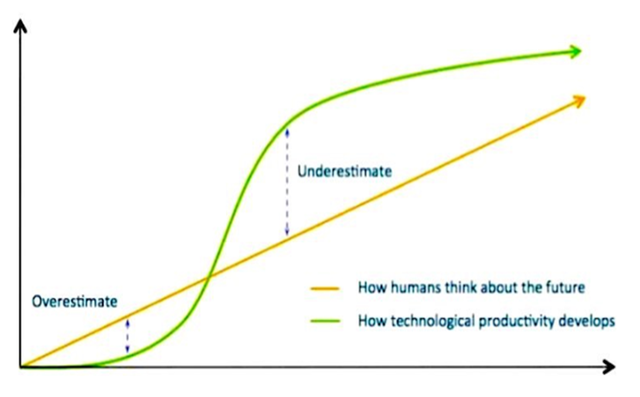

Les marchés financiers ont connu une autre semaine volatile, les variations des prix montrant à la fois des signes de capitulation et de soulagement. Cette semaine, nous avons pensé à la loi d'Amara, qui selon nous s'applique aussi bien aux marchés financiers qu'aux technologies. La loi d'Amara stipule que "nous avons tendance à surestimer l'effet [d'une technologie] à court terme et à sous-estimer son effet à long terme".1 A court terme, les marchés prennent en compte les mouvements de prix entre les classes d'actifs, les flux des investisseurs visant à ajuster le positionnement, et les pertes inévitables des investissements spéculatifs. Les marchés se sont ajustés en conséquence et on peut penser qu'il s'agit d'un surajustement.

Toutefois, les changements structurels globaux, qui étaient en cours et qui ont été accélérés par la pandémie de COVID-19, et le conflit Ukraine/Russie rendent l'horizon à plus long terme plus difficile et les investisseurs pourraient encore sous-estimer leurs effets.

La première accélération est celle de l’inflation. L'excès de liquidités dû à une politique monétaire ultra-accommodante, des marchés du travail tendus, des goulets d'étranglement dans les chaînes d'approvisionnement et des matières premières à des prix élevés ont poussé l'inflation globale à des niveaux critiques.

Cela a conduit à l'accélération de la normalisation de la politique monétaire des banques centrales. En période de crise, le rôle des banques centrales est d'être prêteurs en dernier ressort. C'est ce qui s'est passé avec les systèmes bancaires lors de la grande crise financière de 2007-2008 et avec les marchés du travail lors de la pandémie de COVID-19 ; une fois les bilans bancaires assainis et les économies fonctionnant à des niveaux de plein emploi, nous pourrons conclure que le travail a bien été achevé. En période normale, l'objectif est la stabilité des prix, mais il est plus difficile à justifier à l'heure actuelle. La Grande Crise Financière mondiale a provoqué un choc de demande, le secteur privé ayant réduit son bilan. Les banques centrales se sont inquiétées des pressions déflationnistes et ont cherché à encourager l'investissement et la consommation. La politique monétaire a été considérablement assouplie et une politique non conventionnelle a été déployée par le biais de l'assouplissement quantitatif. Les banques centrales sont maintenant confrontées à un choc de l'offre dans les matières premières, les biens de consommation et les marchés du travail. Cette situation est inflationniste et nous pensons que la politique en place est mauvaise. La politique qui a été mise en place après la grande crise financière doit être inversée. La suppression de la politique monétaire accommodante signifie passer d'un assouplissement quantitatif à un resserrement quantitatif, de taux réels négatifs à des taux réels positifs et d'un objectif de plein emploi à une hausse du chômage.

La tâche des banques centrales n'a pas été facilitée par deux autres changements structurels qui se sont accélérés depuis le début de la pandémie de COVID-19. En premier lieu il faut citer l'accélération de la démondialisation. À mesure que l'activité transfrontalière diminue, le coût des biens et de la main-d'œuvre augmente. En second lieu, il faut rappeler également l'accélération de la décarbonisation et la transition vers des sources d'énergie à plus forte intensité de capital, précisément lorsque l'énergie est à la fois rare et redéfinie comme une question de sécurité nationale.

Nous pensons que le dernier changement auquel les banques centrales seront confrontées sera celui de leurs propres gouvernements, car la combinaison de l'augmentation de l'inflation et des taux d'intérêt pourrait être le cocktail parfait pour accélérer les inégalités, un mot que tous les gouvernements craignent. Nous devrions nous attendre à une plus grande intervention des gouvernements, à une augmentation des dépenses fiscales pour soutenir les niveaux de vie, et au financement des dépenses d'investissement pour l'approvisionnement en énergie et la décarbonisation du secteur énergétique.

Graphique de la semaine – La loi d’Amara :

Alors, qu'est-ce que cela signifie pour les investisseurs ? Probablement plus de volatilité dans laquelle le sentiment des investisseurs oscille entre la sur- et la sous-estimation du besoin d'une compensation du risque dans son ensemble. Heureusement, dans le crédit, pour les investissements qui ne font pas défaut et qui ont donc généralement une valeur finale connue au pair, le calcul approprié de la valeur future est, par définition, relativement plus facile à faire. Nous pensons que les investisseurs trouveront que cela constitue un avantage pour le crédit, dont le prix est actuellement généralement inférieur au pair, mais qui, selon nous, devrait arriver à maturité ou revenir à 100 pour toute entreprise qui continue à honorer ses paiements. Selon nous, le prix et la valeur se rejoindront une fois de plus (tout comme la pensée humaine sur la productivité et, la productivité elle-même se rejoignent dans le graphique ci-dessus), même si pour le moment nous ne voyons pas encore quand aura lieu ce point d'intersection. Et pendant que les investisseurs dans le crédit attendent, ils sont payés. Cette compensation pour l'attente - sous forme de rendement - est plus attractive qu'elle ne l'a été depuis un certain temps.

Le discours du marché est largement négatif. C'est peut-être le moment idéal pour les investisseurs qui ont le courage de commencer à acquérir les « joyaux » du crédit parmi les décombres. Se positionner tôt est une bonne chose quand l'attente peut être bien rémunérée.

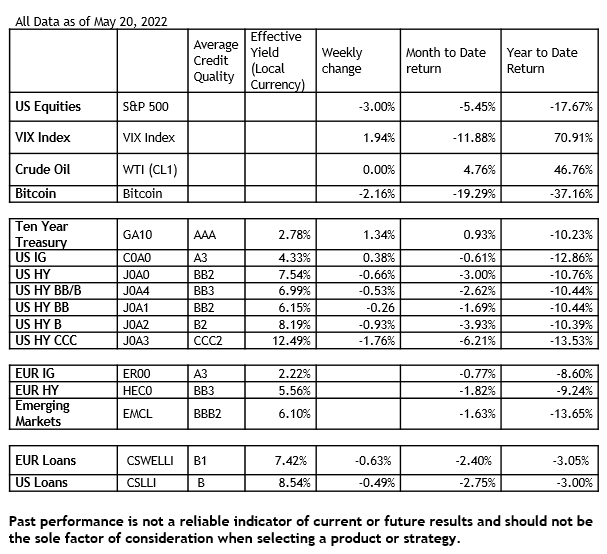

Source : Toutes les données proviennent de ICE BofA au 20 mai 2022, sauf indication contraire.

1. The virtu lab, au 26 janvier 2022

Les performances passées ne sont pas un indicateur fiable des résultats actuels ou futurs et ne doivent pas être le seul facteur à prendre en considération lors de la sélection d'un produit ou d'une stratégie.

Capital à risque. La valeur des investissements et les revenus qu'ils génèrent peuvent baisser ou augmenter et ne sont pas garantis. Les investisseurs peuvent ne pas récupérer l'intégralité du montant investi. Ce document ne doit pas être considéré comme une prévision, une recherche ou un conseil en investissement, et ne constitue pas une recommandation, une offre ou une sollicitation d'achat ou de vente de titres ou d'adoption d'une stratégie d'investissement. Les opinions exprimées par Muzinich & Co sont en date de mai 2022 et peuvent changer sans préavis.

Pour visiter le site, cliquez ICI.

Informations importantes :

La société Muzinich & Co. mentionnée dans le présent document est définie comme Muzinich & Co., Inc. et ses sociétés affiliées. Ce document a été produit à des fins d'information uniquement et, en tant que tel, les opinions qu'il contient ne doivent pas être considérées comme des conseils d'investissement. Les opinions sont celles de la date de publication et peuvent être modifiées sans référence ni notification. Les performances passées ne sont pas un indicateur fiable des résultats actuels ou futurs et ne doivent pas être le seul facteur à prendre en considération lors de la sélection d'un produit ou d'une stratégie. La valeur des investissements et les revenus qu'ils génèrent peuvent baisser ou augmenter, et ne sont pas garantis. Les taux de change peuvent entraîner une hausse ou une baisse de la valeur des investissements. Les marchés émergents peuvent être plus risqués que les marchés plus développés pour diverses raisons, y compris, mais sans s'y limiter, une instabilité politique, sociale et économique accrue, une volatilité accrue des prix et une liquidité réduite du marché.

Toute recherche contenue dans ce document a été obtenue et peut avoir été mise en œuvre par Muzinich pour ses propres besoins. Les résultats de ces recherches sont mis à disposition à titre d'information et aucune garantie n'est donnée quant à leur exactitude. Les opinions et les déclarations sur les tendances des marchés financiers qui sont fondées sur les conditions du marché constituent notre jugement et ce jugement peut s'avérer erroné. Les points de vue et opinions exprimés ne doivent pas être interprétés comme une offre d'achat ou de vente ou une invitation à s'engager dans une quelconque activité d'investissement, ils sont uniquement destinés à des fins d'information.

Toute information ou déclaration prospective exprimée dans ce document peut s'avérer incorrecte. Muzinich ne s'engage pas à mettre à jour les informations, données et opinions contenues dans ce document.

États-Unis : Ce document est réservé aux investisseurs institutionnels et n'est pas destiné à être distribué aux particuliers. Muzinich & Co., Inc. est un conseiller en investissement enregistré auprès de la Securities and Exchange Commission (SEC). Le fait que Muzinich & Co., Inc. soit un conseiller en investissement enregistré auprès de la SEC n'implique en aucun cas un certain niveau de compétence ou de formation, ni une quelconque autorisation ou approbation par la SEC.

Emis dans l'Union européenne par Muzinich & Co. (Ireland) Limited, qui est autorisée et réglementée par la Banque centrale d'Irlande. Enregistrée en Irlande, numéro d'enregistrement de la société : 307511. Adresse du siège social : 32 Molesworth Street, Dublin 2, D02 Y512, Irlande. Emis en Suisse par Muzinich & Co. (Suisse) AG. Enregistrée en Suisse sous le numéro CHE-389.422.108. Adresse du siège social : Tödistrasse 5, 8002 Zurich, Suisse. Emis à Singapour et à Hong Kong par Muzinich & Co. (Singapore) Pte. Limited, qui est autorisée et réglementée par l'Autorité monétaire de Singapour. Enregistrée à Singapour sous le numéro 201624477K. Adresse enregistrée : 6 Battery Road, #26-05, Singapour, 049909. Émis dans toutes les autres juridictions (à l'exception des États-Unis) par Muzinich & Co. Limited. qui est autorisée et réglementée par la Financial Conduct Authority. Enregistré en Angleterre et au Pays de Galles sous le numéro 3852444. Adresse enregistrée : 8 Hanover Street, Londres W1S 1YQ, Royaume-Uni.